For its proposed Chapter 11 bankruptcy restructuring plan, insolvent cryptocurrency lender Celsius Network has selected NovaWulf Digital Management as the sponsor.

On February 15, Celsius filed a document with the United States Bankruptcy Court for the Southern District of New York outlining the strategy. The Celsius Official Committee of Unsecured Creditors (UCC), a group that defends the rights of Celsius account holders, supports the proposed approach.

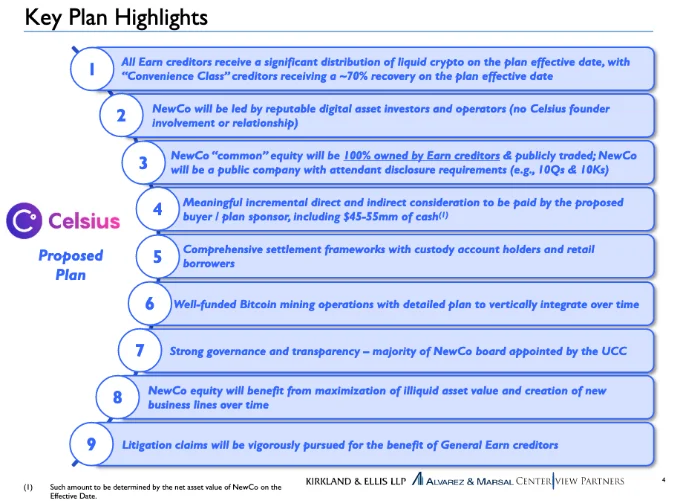

According to the concept, a new public platform named NewCo would be established, owned entirely by Earn creditors, with most of the board members being chosen by the UCC. The new board will not have any “Celsius founder engagement or relationships,” according to the proposal.

Additionally, NovaWulf will provide the new company with a direct financial contribution in the range of $45 million and $55 million.

The NovaWulf proposal “provides the greatest mechanism to disperse the Debtors’ liquid crypto assets and enhance the value of the Debtors’ illiquid assets via a new firm controlled by professional asset managers,” according to Celsius’ petition.

With future intentions to build cryptocurrency-focused services, the new firm will store Celsius’ illiquid assets, mining operations, and current loan portfolio.

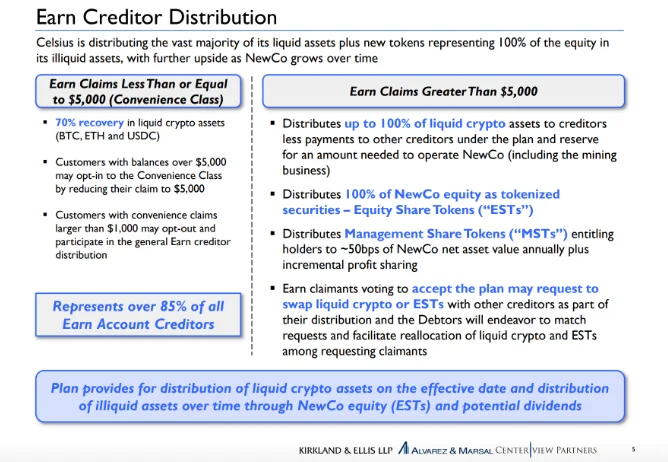

A “one-time distribution of liquid crypto” paid in the form of Bitcoin BTC, Ether, and USD Coin will be given to creditors in the “Convenience Class” who had claims worth $5,000 or less on the petition date.

According to estimates, the option will provide over 85% of Celsius users with a 70% reimbursement of their initially de-deposited cryptocurrency. Any Earn creditor having a debt in excess of $5,000 may choose to lower their claim to $5,000 and join the class.

Following the payments to smaller accounts, individuals with claims above $5,000—or those with claims exceeding $1,000 who choose not to obtain Convenience Class shares—will be paid the remaining cryptocurrency.

They will also acquire ownership in NewCo via equity and management share tokens, the holders of which will earn dividends.

Earn users will be appraised and bought at the initial coin offering (ICO) price of $0.20 if they own Celsius tokens, a native currency used for user incentives that presently trades for roughly $0.50.

According to the scheme, purchasers who had early ICO access or “insider CEL token claims” “get no restitution.”

A “well-funded litigation trust” is to be established as part of the strategy in order to file lawsuits against Celsius executives and former CEO Alex Mashinsky. Before the proposed plan can be implemented, U.S. Bankruptcy Judge Martin Glenn must approve it.

Following communication with “over 130 parties,” Celsius received proposals from six companies, including Binance, Bank To The Future, Cumberland DRW, and Galaxy Digital.

The firm filed for Chapter 11 bankruptcy in July 2022, after suspending withdrawals claiming “severe market circumstances” and rumors of collapse.