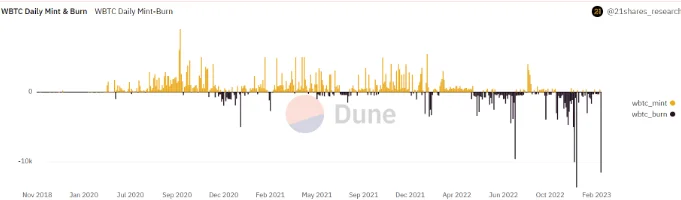

After the second-largest single-day burn of 11,500 Wrapped Bitcoin (wBTC) on February 27, the supply of wrapped Bitcoin (wBTC) fell to its lowest level since May 2021.

11,500 WBTC worth a total of $260 million were burned, resulting in a negative growth rate for the now-defunct crypto lender Celsius. With a monthly growth rate of -7.39, the wrapped token’s current total supply is 164,396 WBTC.

WBTC is an ERC-20 currency based on Ethereum that is linked 1:1 to the price of Bitcoin and mimics its value. In 2019, Bitgo collaborated on the development of wBTC with the multi-chain liquidity platform Kyber and the blockchain interoperability protocol Ren. The decentralized autonomous organization wBTC DAO, which has more than 30 members, also oversees wBTC.

The custodians are informed when a merchant initiates a burn transaction in order to convert BTC to wBTC. The equal quantity of BTC is subsequently transferred by the custodians to the merchant’s bitcoin address. Next, users can convert their wBTC into BTC at businesses, which then burn the obtained tokens.

The fact that wBTC is an ERC-20 token speeds up transfers compared to regular Bitcoin, but its integration with Ethereum wallets, decentralized applications, and smart contracts is by far its biggest advantage.

Wrapped tokens became a common tool for use in the DeFi ecosystem during the height of the bull run. In April 2022, when the price of bitcoin was trading above $48,000, the supply of wBTC reached a peak of 285,000.

The demand began to dwindle, though, with the onset of the bear market and multiple crypto contagions. After the Terra-LUNA-led crypto epidemic that drove some crypto lenders to redeem their wBTC, the first indications of declining demand appeared. One report claims that Celsius Network redeemed roughly 9,000 wBTC due to an increase in withdrawal demand.

In a similar situation, the now-bankrupt cryptocurrency exchange reportedly attempted to redeem 3,000 wBTC just before declaring bankruptcy in November 2022, following the FTX collapse, according to reports.

In November, when the FTX collapsed, over 28,000 wBTC were redeemed back to the original coin, making it the greatest monthly coin redemption for wBTC.

The FTX collapse’s market ripple effect depegged wBTC from the original value of BTC. Even though the slippage was only about 1.5%, it immediately caused severe doubts about the viability of such artificial tokens as a means of value transfer.