Due to the Nigerian central bank’s decision to replace older bank notes with bigger denominations, a shortage of fiat currency hit the Nation leading to a rise in its central bank digital currency (CBDC) adoption.

Due to rising inflation, the Nigerian central bank decided to replace outdated bank notes with larger denominations, resulting in a severe cash shortage. Even though developing nations were among the first to recognize the necessity of a CBDC in modernizing fiat capabilities, the concept has yet to be realized.

The scarcity of tangible currency, however, compelled Nigerians to adopt the eNaira. Bloomberg reported that the value of eNaira transactions jumped 63% to 22 billion Naira ($47.7 million) in a country where cash accounted for over 90% of transactions.

In addition, according to Godwin Emefiele, governor of the Central Bank of Nigeria, the total number of CBDC wallets has increased by more than 12 times since October 2022, reaching 13 million now.

The demonetization lowered the amount of currency in circulation from 3,2 trillion Naira to one trillion Naira. To offset this drop, Nigeria issued approximately 10 billion eNaira. eNaira rewards in government initiatives and social programs also help to increase CBDC use.

CBDCs provide a means for poor nations to overcome obstacles given by the fiat economy, such as cutting operating expenses and bolstering Anti-Money Laundering activities.

Emefiele said, “eNaira has emerged as the preferred electronic payment channel for financial inclusion and performing social initiatives.”

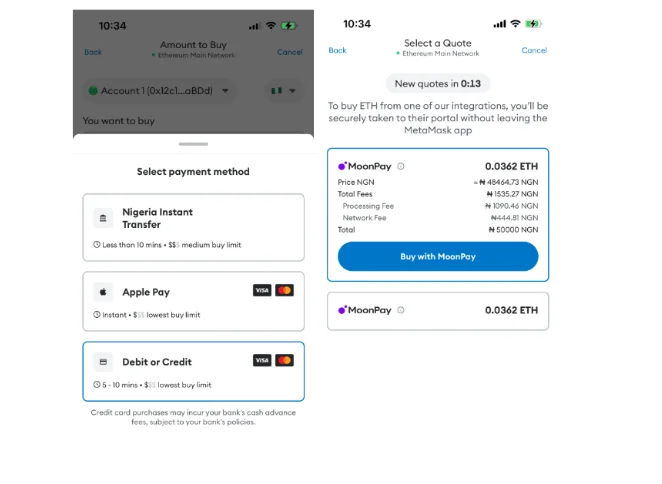

In response to the cash shortage, Nigerians now have a new alternative for acquiring cryptocurrencies. ConsenSys, the parent company of MetaMask, recently announced a new MoonPay connection that enables Nigerians to acquire cryptocurrencies via bank transfers.

As illustrated in the screenshot above, the new feature is available on the MetaMask mobile and Portfolio DApp, substantially easing the process of purchasing cryptocurrencies in Nigeria without using credit or debit cards.