The Binance CEO shared his views on the future of Bitcoin, BlackRock’s entry into crypto, and Binance’s regulatory challenges in a Twitter session.

In a recent interactive Twitter session, Changpeng “CZ” Zhao, the CEO of Binance, made a bold prediction for the next Bitcoin bull market.

The information session, held on July 5, covered a range of topics, including traditional financial institution BlackRock’s entry into the crypto market and ongoing regulatory concerns involving his platform.

The Bitcoin Halving Cycle

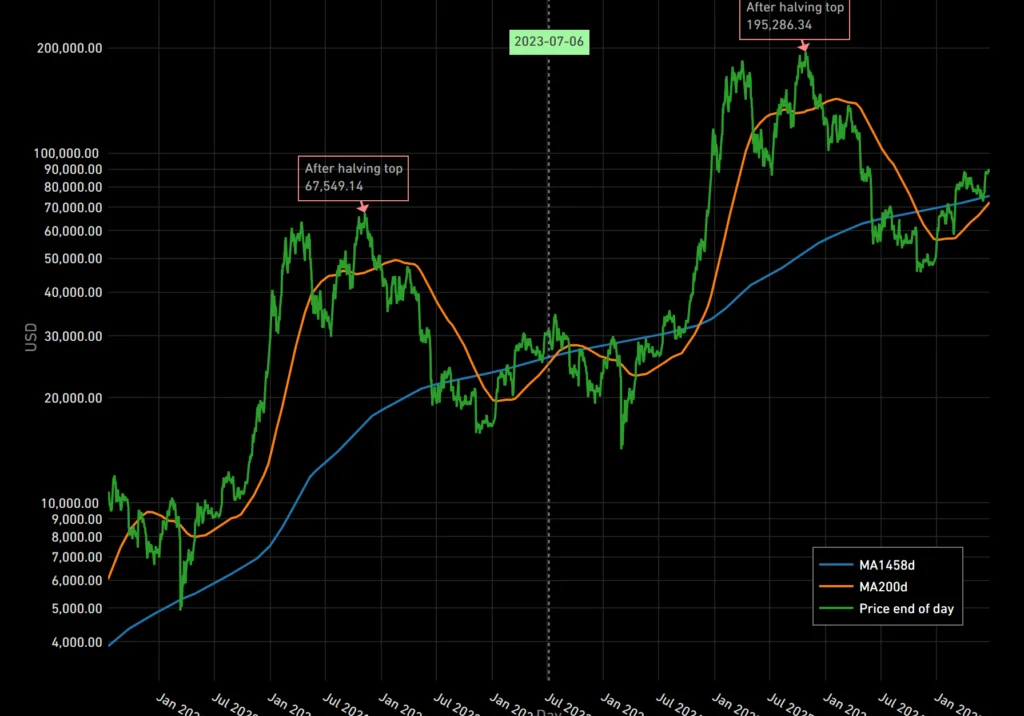

According to Zhao, the Bitcoin bull market, which has historically followed four-year cycles, will likely resume in 2025. This prediction is largely based on the timing of the next Bitcoin halving event, set to occur in 2024.

Bitcoin has a built-in deflationary mechanism in the form of “halving events,” which occur approximately every four years. During these events, the reward for mining new Bitcoin is cut in half, resulting in reduced supply and potential price increases due to scarcity.

Historically, the Bitcoin price has often experienced a significant surge following these halving events. This time-tested pattern led Zhao to declare that “the year after Bitcoin halving is usually the bull year.”

While noting that he doesn’t possess the ability to foresee the future with certainty, Zhao’s experience and insight into the cryptocurrency market make his predictions a noteworthy conversation

The BlackRock Factor

Another key subject of the Twitter conversation was BlackRock’s recent foray into the spot Bitcoin exchange-traded fund arena. Since the firm’s June 15 filing, some apprehension has occurred within the crypto community.

Critics worry that the entry of major traditional financial firms like BlackRock could directly oppose Bitcoin’s decentralized ethos, potentially bringing undue centralization and regulation.

Zhao expressed his optimism about BlackRock’s move, saying that it could bring more exposure and adoption to Bitcoin and crypto in general. He also stated that he doesn’t see BlackRock as a competitor or a threat to Binance or other crypto platforms.

He argued that BlackRock’s offering differs from Binance’s products and services and that there is enough room for multiple players in the crypto space.

Zhao also pointed out that BlackRock’s entry into crypto could positively impact the regulatory landscape, as it could encourage more regulators to embrace and support crypto innovation.

He said that he hopes that regulators will view crypto as an opportunity rather than a risk and that they will work with the industry to create a fair and conducive environment for crypto development.

Binance’s Regulatory Challenges

In the backdrop of these discussions is a wave of regulatory scrutiny confronting Binance. When asked about the status of these issues during the Twitter session, Zhao acknowledged the existence of regulatory concerns without delving into specifics.

Zhao reassured his audience that Binance is committed to finding the most expedient, reasonable, and mutually agreeable solution to these regulatory challenges.

He said Binance is working closely with regulators and partners worldwide to comply with their requirements and expectations.

He also said that Binance is investing heavily in enhancing its compliance systems and processes, as well as hiring more compliance professionals.

Zhao emphasized that Binance’s mission is to increase crypto accessibility for everyone and that it respects and supports all legitimate efforts to protect users and prevent illicit activities.

CZ said that Binance is not against regulation but rather seeks constructive and collaborative regulation that balances innovation and protection. He added that Binance is open to dialogue and feedback from all stakeholders, including regulators, customers, partners, and peers.

Zhao concluded his Twitter session by thanking his followers for their support and trust and expressing his confidence in the future of Binance and cryptocurrency.