Binance cryptocurrency exchange announced the addition of 22 new loanable assets and collateral assets, including Shiba Inu, to its Flexible Loan and VIP Loan services on Friday, August 4.

The crypto exchange disclosed several new collateral assets in its official statement, including Shiba Inu, Compound, and Theta Network.

This development has also fuelled rumors regarding the potential listing of BONE token on Binance, coinciding with the anticipated August launch of the Layer-2 blockchain, Shibarium.

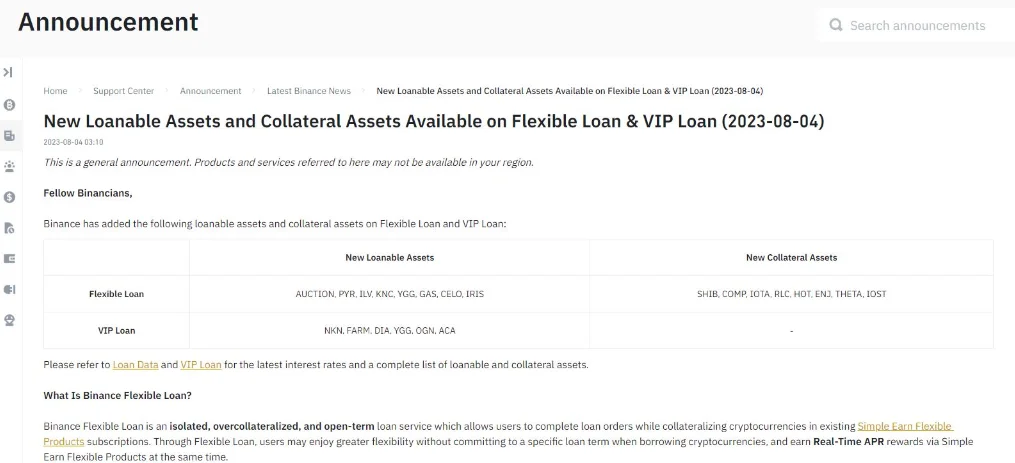

The cryptocurrency exchange simultaneously announced the addition of 22 cryptocurrencies to its Flexible Loan and VIP Loan services as loanable and collateral assets.

Binance has added eight new loanable assets to its Flexible Loan service, including AUCTION, PYR, ILV, KNC, YGG, GAS, CELO, and IRIS. In addition, six new loanable assets have been added to the VIP Loan service: NKN, FARM, DIA, YGG, OGN, and ACA.

In a distinct announcement, Binance introduced XEM as a newly available borrowable asset on Cross Margin. The XEM/USDT pair is now available for trading on the cross-margin platform.

BONE has been listed on multiple cryptocurrency exchanges, such as OKX, Huobi, and Crypto.com, following the introduction of the Shibarium testnet PuppyNet. The Shibarium testnet’s accomplishments reflect the increasing demand for the chain and its token, BONE.

The prospective listing of the BONE token is contingent on the upcoming launch of Shibarium’s mainnet, which is one of the listing requirements for new cryptocurrencies. The lead developer, Shytoshi Kusama, had previously disclosed that the August launch of Shibarium was possible.

SHIB is trading at $0.0000083, roughly a 2% increase in the last 24 hours. In contrast, the price of BONE has increased by 1% over the past 24 hours and by a significant 24% over the past week.