The SEC has postponed its decision on seven spot Bitcoin ETF applications, dampening the crypto market sentiment. This comes after Grayscale’s legal victory over the SEC, which had raised hopes for early approvals.

The crypto market took a hit on Thursday as the U.S. Securities and Exchange Commission (SEC) delayed its decision on applications for seven spot Bitcoin exchange-traded funds (ETFs), which would track the current price of the cryptocurrency.

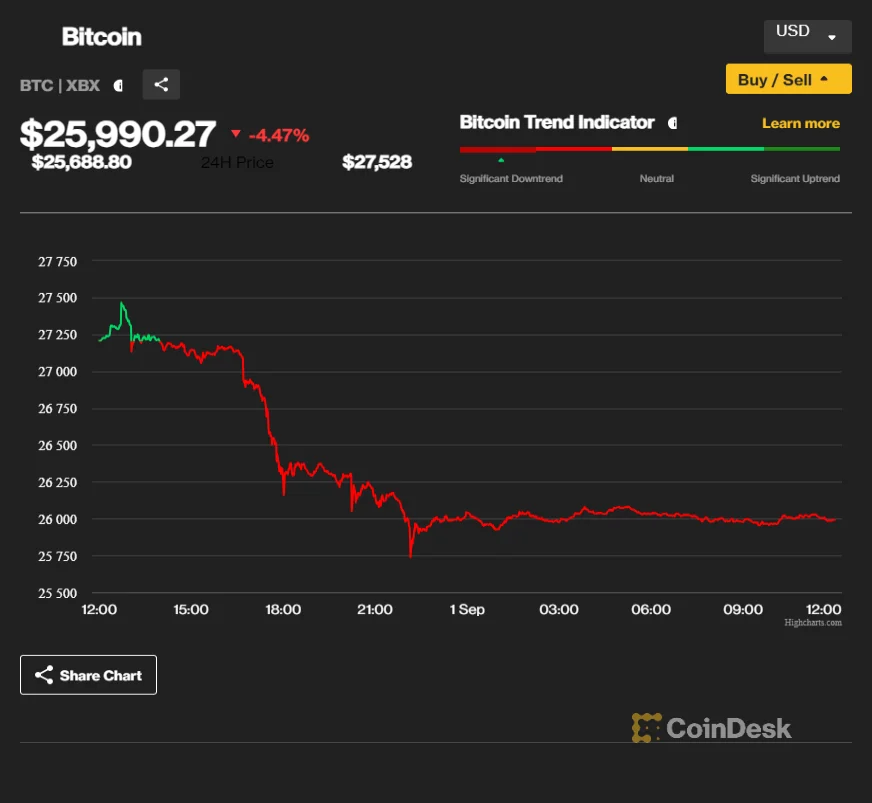

Bitcoin fell 4.6% in the past 24 hours, while Ethereum lost 3.6%. Bitcoin Cash plunged 7.3%, and XRP was down more than 4% after the SEC announced its postponement.

Why Spot Bitcoin ETFs Matter

Spot Bitcoin ETFs are seen as a major breakthrough for the crypto industry, as they would allow investors to gain exposure to Bitcoin without having to buy, store, or secure the digital asset themselves.

They would also provide more liquidity, transparency, and efficiency to the Bitcoin market and attract institutional and retail investors looking for a regulated and convenient way to invest in the cryptocurrency.

Spot Bitcoin ETFs differ from Bitcoin futures ETFs, which track the price of Bitcoin futures contracts traded on regulated exchanges such as the Chicago Mercantile Exchange (CME).

Bitcoin futures ETFs do not hold actual Bitcoin but rather contracts that promise to deliver Bitcoin at a specified date and price in the future.

They are subject to contango, which means that the futures price is higher than the spot price, resulting in a negative roll yield for investors.

The SEC has already approved several Bitcoin futures ETFs, such as the ProShares Bitcoin Strategy Fund (BITO) and the Valkyrie Bitcoin Strategy Fund (BTF), which began trading in October 2021.

However, many crypto enthusiasts and investors prefer spot Bitcoin ETFs, as they believe they would better reflect the true value of Bitcoin and have lower fees and risks.

Grayscale’s Legal Win Against the SEC

The SEC’s delay on spot Bitcoin ETF applications came as a surprise to some investors, who had become more optimistic about early approvals following Grayscale’s landmark legal win against the SEC earlier this week.

Grayscale is the largest crypto asset manager in the world, with over $50 billion in assets under management. It runs the Grayscale Bitcoin Trust (GBTC), which is an over-the-counter