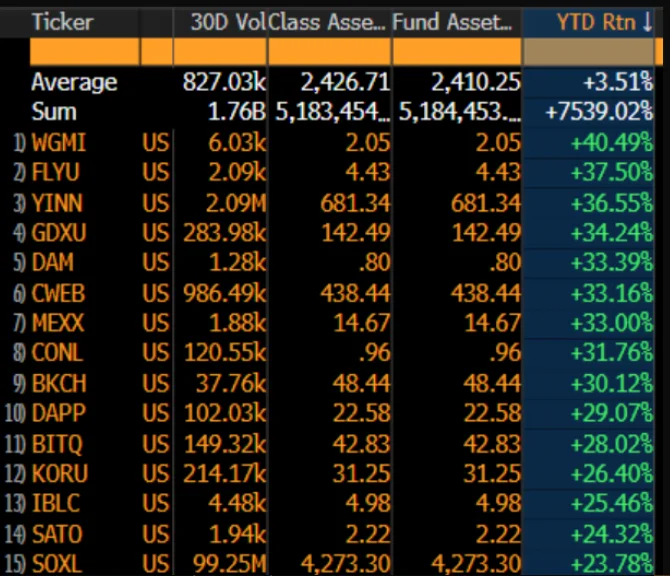

In the spirit of the bullish trend in the crypto market this year, Valkyrie’s Bitcoin Miners ETF (WGMI) has attained the position of the top equity exchange-traded fund (ETF) and has increased by 40% this year so far.

The Bitcoin mining ETF is not only dominating the market for standard equities ETFs but also for leveraged equity ETFs, which is unusual. Eric Balchunas, a senior ETF analyst for Bloomberg, said that the Valkyrie Bitcoin mining ETF is quite “concentrated,” investing in only 20 companies, including significant companies like Agro Blockchain, Bitfarm, and Intel.

In February 2022, the WGMI ETF was launched on Nasdaq, although it didn’t make direct investments in Bitcoin. 80 percent of its net assets provide exposure through the securities of businesses that get at least half of their income or profits from mining bitcoin.

The remaining 20% is invested by Valkyrie in businesses that have “a considerable amount of their net assets” held in bitcoin.

The ProShares Bitcoin Strategy ETF, which was introduced in October 2021 and tracked Bitcoin values via futures contracts traded at the CME, was the first Bitcoin ETF to get approval in the United States.

The first ETF saw $1 billion in trading activity on its first day, gaining a lot of early market momentum. Many thought that this would ultimately persuade authorities to authorize the first spot market-based ETF in 2022 due to its success, but a protracted crypto winter and crypto contagions changed the tide against the crypto ETFs.

In 2022, cryptocurrency-related ETFs in Australia and the US were the two worst-performing ETFs, respectively. According to statistics from ETF.com, the top four worst-performing U.S. ETFs for 2022 were tied to cryptocurrencies.

For the cryptocurrency sector to achieve widespread acceptance, crypto ETFs were seen as the next significant step. However, the lengthy crypto bear market and many crypto epidemics in 2022 stole the show.