Solana (SOL) is facing downward pressure as the market anticipates a large sell-off of its tokens by the troubled FTX exchange. Can SOL rebound from this challenge and break above the $20 resistance level? [Read more]

Solana’s (SOL) price has recently shown resilience after Visa announced its plans to introduce USDC settlement over the Solana network.

However, the market also buzzes with speculation around potential liquidation by the FTX exchange, which holds a substantial amount of Solana tokens.

Visa Boosts Solana with USDC Settlement Plan

Last Tuesday, Visa revealed its intention to facilitate USDC settlements on Solana, which increased the cryptocurrency’s price by 4.39% to $20.25.

Besides this, other major cryptocurrencies like Bitcoin and Ethereum stayed relatively flat.

The announcement is a big vote of confidence in Solana, which many see as a viable Ethereum alternative because of its speed and low costs.

In addition, PayPal USD, its branded stablecoin, went public, lending more legitimacy to the cryptocurrency business.

Adding to Solana’s appeal is Bernstein Research’s prediction that the stablecoin industry would grow to approximately $3 trillion over the next five years.

FTX Liquidation Looms Over Solana

Solana, though, is shrouded with doubt because of FTX’s shaky standing. The exchange may be compelled to sell its massive stash of Solana tokens to settle its debts.

As a result, the crypto market is already displaying symptoms of lower trade volumes, making it more vulnerable to recent news.

FTX, after its financial downturn last November, has made it clear through court filings that it plans to repay creditors in fiat currency.

To facilitate this, Galaxy has been entrusted with liquidating FTX’s assets, including a notable chunk of Solana tokens.

The liquidation is capped at $50 million for the first week and can temporarily be increased to $200 million to mitigate adverse impacts on the market.

While the liquidation in a high-volume market would be less concerning, the current low-volume scenario could amplify the effect of this sell-off.

Solana’s founder has also expressed concerns, suggesting an alternative of directly distributing Solana tokens to FTX’s customers.

Solana Price Analysis

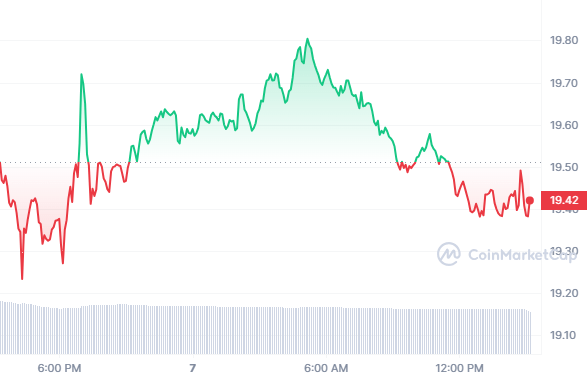

In the previous 24 hours, the price of Solana (SOL) has ranged from a high of $19.84 to a low of $19.22, remaining consistently below the $20 threshold.

At the time of writing, the price of SOL was $19.49, down 1.37% from its intraday high.

A break of the $19.22 support level may cause SOL to fall below $18.50, a significant psychological milestone for traders to monitor.

However, if SOL manages to break over the $19.84 resistance level, it can surge towards the $20.50 level.

The following chart shows the price movements of SOL in the past 24 hours:

Conclusion

Solana (SOL) is facing a tough challenge as it tries to maintain its momentum amid the looming threat of FTX liquidation. The cryptocurrency has received some positive news from Visa and PayPal, but it may not be enough to overcome the bearish sentiment in the market.

Traders should watch out for the key price levels and look for signs of a reversal or a continuation of the downtrend.

Disclaimer: This analysis aims to provide objective insights into possible price movements. Readers should do more research and analysis before investing. Coinscreed and its affiliates are not liable for any damage or loss.