Cryptocurrency exchange FTX has petitioned a US District Court to allow Galaxy Digital, a digital asset management company, to manage the remaining cryptocurrency holdings of the bankrupt exchange.

The company filed a petition with the United States District Court for the District of Delaware on August 24, requesting permission and approval of guidelines for the sale of digital assets recovered during ongoing bankruptcy proceedings.

The filing describes FTX’s requests and plans to transfer approximately $7 billion worth of recovered cryptocurrency tokens under Galaxy Digital’s administration following the collapse of the exchange in 2022.

As stated in its preliminary statement, FTX intends to account for the prospective sale of its cryptocurrency holdings and stake tokens through Galaxy Digital.

The filing describes a “comprehensive management and monetization plan” for the company’s cryptocurrency holdings, which aims to reduce exposure to volatility and potential fiat repayments to creditors.

FTX intends to retain Galaxy Digital as a registered investment adviser, utilizing its “specialized knowledge” of digital asset markets to maximize the value of the company’s token portfolio.

The company cited some potential advantages of the partnership, such as the ability to sell its holdings anonymously into the markets and reduce the risk of market manipulation.

“Similarly, the Debtors expect that the Investment Adviser’s expertise will be crucial in assessing

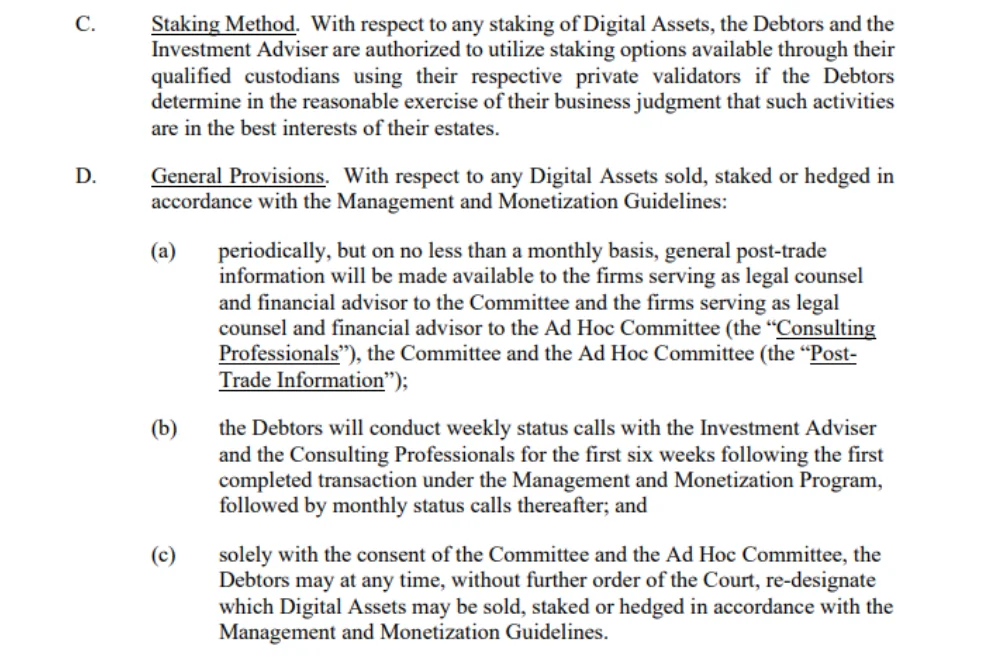

Galaxy Digital will be responsible for hedging Bitcoin and Ether before any prospective sales, according to the general investment guidelines outlined by FTX.

FTX will seek to sell its crypto holdings for fiat currency to reduce its exposure to market volatility while taking advantage of liquid hedging markets for Bitcoin and Ether to reduce its exposure to unanticipated price fluctuations before their sale.

Decentralized Finance is also mentioned in the filing, with FTX noting that it intends to stake particular cryptocurrencies to generate passive yield income under Galaxy Digital’s supervision:

@@@

As bankruptcy proceedings continue, FTX recently submitted a reorganization proposal to create a new offshore exchange. This could allow creditors to choose between receiving a portion of their lost funds or opting for an amount of equity, tokens, or other interests in an FTX reincarnation.