Tether (USDT) market share on Binance rising again suggests a Bitcoin and crypto market rally.

The decision by Binance, the largest cryptocurrency exchange in the world, to pull out of the BUSD and TUSD stablecoins due to regulatory obstacles has generated optimism among traders.

According to Kaiko data, the Tether (USDT) market share on Binance is once again increasing, which may signal the beginning of a Bitcoin and cryptocurrency market rally.

USDT Volume Share Gains While TrueUSD Volume Share Declines On Binance

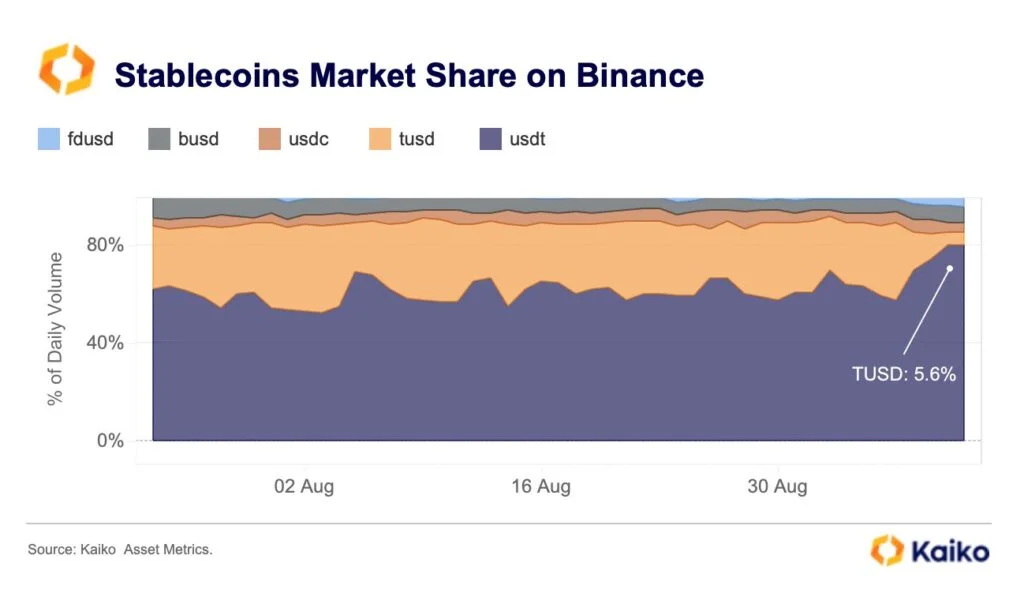

Kaiko, a provider of data on digital assets, reports that the market share of TrueUSD (TUSD) on the crypto exchange Binance has dropped from more than 30% to just 5.6%.

The daily trading volume share of TUSD stablecoin has fallen below the market share of BUSD, which Binance intends to stop supporting in early 2024.

Moreover, the trading volumes of USDT and FDUSD on Binance have substantially increased, with USDT’s market share reaching 80%. After Binance announced zero-cost Bitcoin and Ethereum trading with the FDUSD stablecoin, FDUSD market share increased as well.

Binance decided to modify its zero-fee Bitcoin spot and margin trading pair BTC/TUSD. Traders have left the TUSD market because the purchaser fee is no longer free.

How Does USDT Trading Volume on Binance Benefit the Crypto Market?

Binance appears to be discontinuing its zero-fee Bitcoin trading program for TrueUSD (TUSD), reducing its support for the TrueUSD (TUSD) stablecoin in light of a number of issues.

Experts have identified a number of red flags for TUSD, causing a commotion in the cryptocurrency market.

A surge in USDT trading volume will prevent unwarranted risks and restore Binance’s lost trading volume. It will contribute to the crypto market’s bullish momentum and resolve liquidity concerns.

As Bitcoin price remains above $26,000, analysts are already optimistic about the beginning of a bullish cycle.