Block, a Bitcoin-focused fintech company led by Jack Dorsey, disclosed its third-quarter (Q3) earnings report, which indicated a successful quarter with Bitcoin revenue contributing as much as 43% of its total revenue.

Solid revenue growth in Cash App and Square contributed to the company’s $5.62 billion in revenue for the third quarter of 2023. Profit on Bitcoin holdings increased by $44 million due to a price surge in recent months.

Jack Dorsey provided an update to shareholders in a letter detailing the organization’s strategic direction and future objectives, with a particular emphasis on Square, in addition to the significant financial indicators from the third quarter.

According to Dorsey, the organization had authorized the repurchase of $1 billion worth of shares to compensate for a fraction of the dilution caused by share-based compensation.

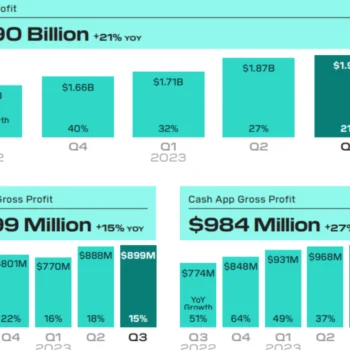

Block demonstrated a year-over-year increase in gross profit to $1.90 billion during the third quarter of 2023. Cash App, a mobile payment service, generated a gross profit of $984 million, representing a 27% year-over-year increase. In comparison, Square recorded a gross profit of $899 million, representing a 15% year-over-year increase.

Bitcoin-generated revenue comprised roughly 43% of Block’s total revenue of $5.6 billion. Additionally contributing to the third-quarter expansion of fintech companies were robust consumer demand and positive spending.

The Bitcoin gross profit of Block increased by 22% year-over-year to $45 million, with the company selling $2.42 billion worth of BTC to clients through the Cash App.

The Bitcoin gross profit of the company amounted to 2% of the Bitcoin revenue. The company asserted that an increase in the average market price of Bitcoin and the volume of Bitcoin sold to customers were the primary factors driving BTC revenue.

Block reported that since the previous quarter, it has not incurred any impairment losses on its Bitcoin holdings. As of September 30, 2023, the carrying value of Block’s Bitcoin investment was $102 million.

However, upon analysis of observable market prices, the investment’s fair value exceeded its carrying value by $114 million, amounting to $216 million.