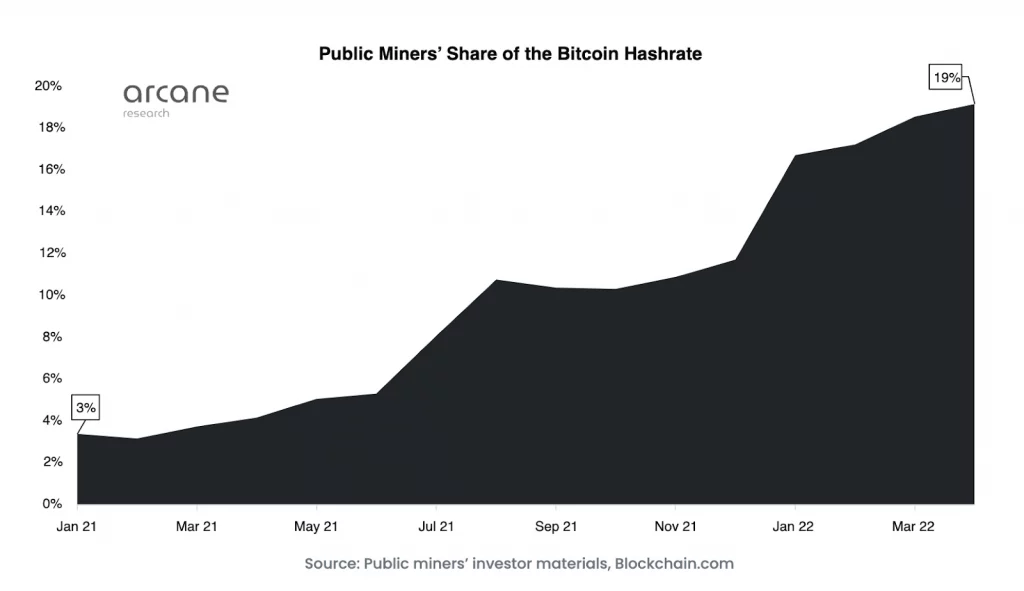

As the growing number of Bitcoin miners go public, the total share of the Bitcoin hash rate owned by publicly traded companies has increased over the past year.

According to recent research, publicly-traded mining companies currently possess roughly one-fifth of the overall share of Bitcoin’s (BTC) hash rate.

According to the research, which was published by Arcane Research, publicly-traded Bitcoin mining businesses now account for 19% of Bitcoin’s overall hash rate, up from 3% in January.

The hash rate is the amount of computational power utilized by a miner’s computing equipment to confirm a transaction. A higher hash rate ensures more security against double-spending attacks, which involve undoing BTC transactions on the blockchain by providing at least 51 percent of the Bitcoin hash rate.

While there were only a few public mining firms at the start of last year, there are now a total of 26 distinct public companies active in Bitcoin mining, owing to the increased number of mining companies becoming public.

According to the report, the increase in the number of public mining businesses has been driven by public companies having easier access to finance, allowing them to expand their mining fleets faster than private competitors.

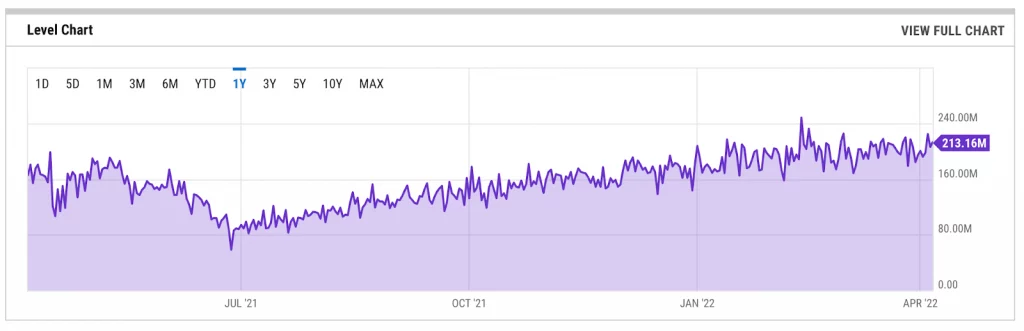

According to the most recent data from the Cambridge Bitcoin electricity consumption index, North American miners currently account for 44.95 percent of the worldwide hash rate. This number is predicted to rise due to huge forecasted increases in Bitcoin hash rate among publicly listed Bitcoin miners, implying that the Bitcoin network will gradually become more centralized over time.

Bitcoin mining has increased significantly in recent years, with the crypto asset’s hash rate reaching a new all-time high of 248.11 exahashes per second (EH/s) on February 18. The network’s hash rate is currently 213.16 EH/s or approximately two hundred and thirteen quintillion hashes per second.