Marathon announced a 467% increase in BTC production year-on-year in the third quarter, while hashrate rose over 400% in the same timeframe.

The revenue of Marathon Digital Holdings, a company that mines Bitcoin, increased by 670% annually during the third quarter of 2023, as Bitcoin production increased by nearly fivefold.

Marathon also turned a profit for the quarter, reporting $64.1 million in net income for the third quarter, as stated in the company’s results filing dated November 8.

The company ascribed a portion of the enhanced financial outcomes to a 467 percent increase in Bitcoin (BTC) production, which rose from 6.7 BTC mined daily in the third quarter of 2022 to 37.9 BTC mined daily in the third quarter of 2023. Similarly, Marathon’s energized hashrate increased by 403% during the same period.

Marathon’s Q3 Earnings Release is here:

– Revenue of $97.8M, due to 467% increase in #Bitcoin production and higher BTC prices.

– Adjusted EBITDA improves to $43.7M.

– 8% increase in hash rate; expanding with hydro-powered ventures in Paraguay.

– Long-term debt reduced by 56%,…

— Marathon Digital Holdings (NASDAQ: MARA) (@MarathonDH) November 8, 2023Marathon’s newly announced 27-megawatt hydro-powered mining venture in Paraguay contributed to a portion of its hashrate increase on November 8.

Fred Thiel, chief executive officer and chairman of Marathon, stated that the “significant progress” has aided in the firm’s balance sheet fortification before the April 2024 Bitcoin halving event.

Thiel noted that a note exchange worth $417 million that was finalized in September reduced Marathon’s long-term debt by 56% and generated cash savings for shareholders of over $100 million.

“For the first time in two years, our combined cash and bitcoin holdings exceeded our debt at the quarter’s end.”

Conversely, Marathon maintains its resolve to augment its hashrate within the immediate to intermediate future. Presently, the implemented hashrate stands at 23.1 exahashes per second; however, the organization intends to increase it to 26 EH/s by 2024, with an additional 30% target.

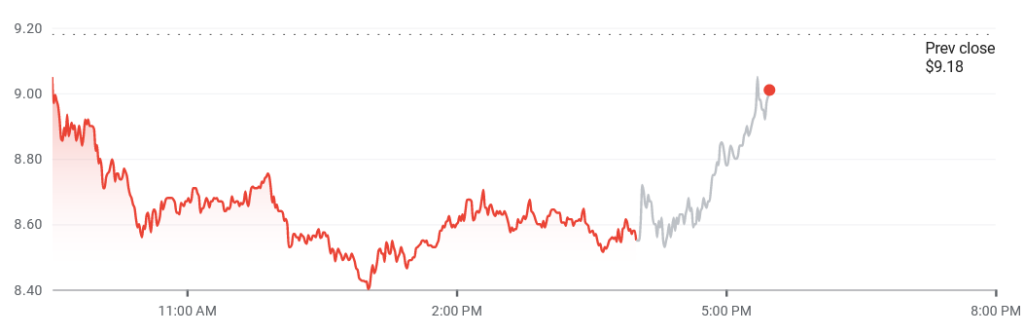

According to a report, Marathon and Riot are among the most overvalued Bitcoin mining equities. And according to Google Finance, Marathon’s (MARA) share price decreased 6.9% to $8.55 on November 8 but rebounded 4.3% in after-hours trading after the company’s earnings statement was released.