The anticipation that the United States will soon authorize a spot Bitcoin exchange-traded fund (ETF) has boosted demand for the leading Bitcoin and caused a surge in transaction fees.

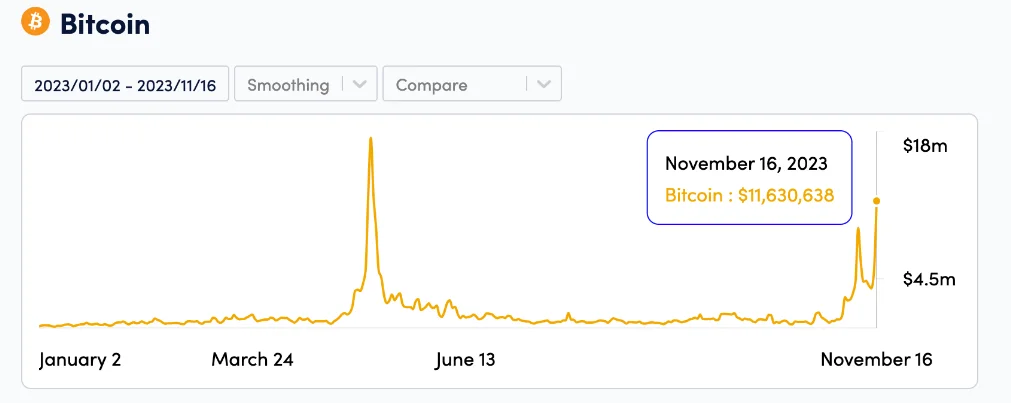

According to statistics compiled by CryptoFees, the Bitcoin blockchain received $11.6 million in fees paid on November 16. According to data from YCharts, the mean transaction fee increased by 113% from the previous day and 746% from last year. It is currently $18.69.

Per market analysis, Bitcoin continues to trade above its bear market trading range and near its highest level in eighteen months. The cryptocurrency was trading at $36,407 at the time of writing, an increase of 0.58% in the preceding twenty-four hours.

Since June, when investment manager BlackRock of Wall Street registered for a spot BTC ETF with the Securities and Exchange Commission (SEC), the price of Bitcoin has been on the rise.

Following BlackRock’s application, several other prominent asset managers in the United States, including Fidelity, ARK Invest, and WisdomTree, among others, submitted comparable proposals.

While the SEC is discussing adjustments to their proposals with the firms, it has yet to decide which will postpone definitive deadlines until January 2024. WisdomTree submitted an amended Form S-1 to the regulator on November 16. Subsequently, ARK, 21Shares, Valkyrie, Bitwise, and VanEck submitted similar amendments.

Eric Balchunas, a senior ETF analyst at Bloomberg, speculates that the revised versions could address the SEC’s concerns. “This indicates that ARK has acknowledged and addressed all of the SEC’s comments, putting the ball back in the SEC’s court,” Balchunas explained. “[A positive sign, solid progress, in my opinion]”

An investment fund known as a spot bitcoin ETF tracks the price of bitcoin. The “spot” component denotes that the fund purchases Bitcoins as the fundamental asset in advance.

This feature allows investors to use their standard brokerage accounts in the Bitcoin market. It enables you to gain exposure to the fluctuating price of Bitcoin without, for instance, having to purchase it on a cryptocurrency exchange.

Institutional investors are expected to allocate capital towards the spot Bitcoin ETF, potentially leading to further ascents in the price of Bitcoin over the next few months. Analysts at Bloomberg estimate that ratification of every proposal in the same batch in January is 90% probable.