Bitmain has received an order for 35,888 Antminer T21 Bitcoin mining equipment from Bitfarms, with each unit costing $2,660.

The statement states that the transaction will involve roughly $95.5 million. Delivery of the equipment is scheduled for March–May 2024, furthermore, Bitfarms has also been granted the option to buy an extra 28,000 Antminer T21.

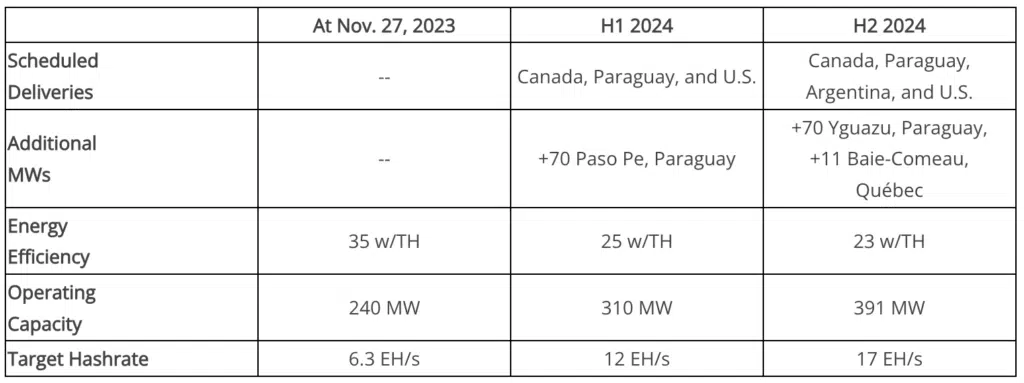

In the first half of 2024, the corporation plans to increase the hashrate to 12 EH/s with an installed capacity of 310 MW after deploying the bought installations.

The numbers are expected to reach 17 EH/s and 391 MW, respectively, by the end of the year. A miner’s or mining pool’s profitability is directly correlated with hashrate.

The likelihood of earning a reward for creating a block increases with the hashrate of the miner. It is anticipated that the new gadgets will greatly boost miners’ capacity to mine Bitcoin (BTC).

“The most attractive prices for equipment since 2020,” according to Bitfarms President and CEO Jeff Morphy, enabled the business to start a comprehensive program to update its fleet of miners.

As a result, he continued, the equipment of the company should have an average energy efficiency of 23 W/TH. Bitfarms CEO and President Jeff Morphy stated:

“This strategy is expected to significantly increase efficiencies along with lower unit production costs and dramatic hashrate growth, positioning us well for the upcoming Halving and beyond.”

Bitfarms will spend $60 million CAD (Canadian dollars), or $44.1 million USD, that was raised through an additional private sale of shares to partially finance the acquisition of equipment.

In October, Bitmain unveiled the Antminer T21. The installation’s hashrate and energy consumption are marginally lower than those of the flagship S21, which was unveiled in August. The gadget is intended to be used for mining SHA-256 coins, such as Bitcoin, Bitcoin Cash, and Bitcoin SV.