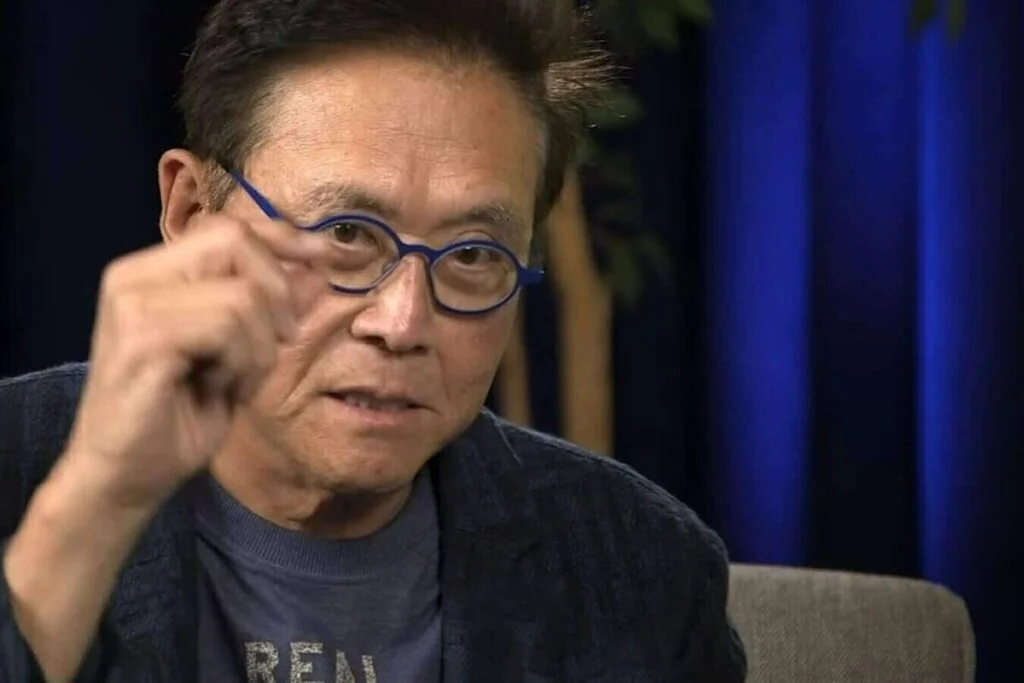

Amid geopolitical tensions, Robert Kiyosaki advises the purchase of Bitcoin and other assets, highlighting its function as a hedge against economic recession.

Renowned author Robert Kiyosaki, best known for his book “Rich Dad Poor Dad,” has reaffirmed his stance on Bitcoin as the largest crypto by market cap hit its highest level in about 19 months.

Furthermore, he has expressed his distinct viewpoint on the Israel-Hamas conflict via social media, drawing a connection between this viewpoint and his choice of electric vehicle (EV) acquisition.

Kiyosaki suggests that an oil-related motive underpins the conflict, wherein he critiques the position of President Joe Biden and cautions against the possible economic repercussions of increased gasoline prices.

Significantly, he advocates for his followers to invest in alternative assets such as gold, silver, and, most notably, Bitcoin to resist and protect their financial well-being.

Robert Kiyosaki Encourages the Purchase of Bitcoin Amid Geopolitical Unrest

In a recent post on the X platform, Robert Kiyosaki recently shared his concerns regarding the Israel-Hamas conflict, attributing his choice to buy an electric vehicle to the conflict’s correlation with oil.

Significantly, he expressed his skepticism regarding President Biden and what he considers to be a puppetry performance orchestrated by “woke liberals.”

Furthermore, Kiyosaki counsels individuals to assume authority over their financial prospects through investments in physical assets such as gold and silver.

However, he emphasizes the importance of Bitcoin as a safeguard against potential economic recessions that may result from political choices.

Meanwhile, Kiyosaki’s audacious position is consistent with his previous endorsements of Bitcoin as a safeguard against economic unpredictability.

The conveyed message suggests that cryptocurrency might function as a haven during periods of geopolitical unrest, highlighting its decentralized structure and autonomy from conventional financial systems.

Recovery Path Of Gold & Bitcoin

Amidst Kiyosaki’s promotion of alternative assets, there has been a significant increase in Asian trade involving gold prices.

This rally was fueled by market speculation that the Federal Reserve might commence interest rate cuts as early as March 2024.

Furthermore, a less assertive posture from central banks, easing inflation, and subdued labor market data all contribute to the optimistic outlook on gold.

However, a potential impending recession remains an underlying concern that may have contributed to the recent gold uptrend.

Notably, gold has historically functioned as a protective measure against economic contractions.

Conversely, the intensification of the Israel-Hamas conflict exacerbated apprehensions, prompting investors to seek refuge in conventional safe-haven assets such as gold.

Amid global political and economic unpredictability, Kiyosaki’s exhortation to “fight back” against prospective economic challenges is consistent with the prevailing pattern of investors seeking refuge in alternative assets such as Bitcoin and gold.

In the 24 hours before this writing, the price of Bitcoin peaked at $41,525.46 and is currently trading at $41,446.94, an increase of 5.11% from yesterday.

Conversely, February Gold futures increased 0.77% to $2,106 at the same time.

In terms of year-to-date performance, Bitcoin has generated gains of approximately 144%, whereas the latter has only surged by about 16%.