On November 25, Babylon Labs and Lombard Protocol indicated they are in the process of implementing liquid Bitcoin staking on the Sui network, starting in December.

According to the announcement, Bitcoin holders on Sui can stake BTC to Babylon, a Bitcoin layer 2 (L2) network, and mint LBTC, Lombard’s liquid staking token (LST), beginning in December.

According to Sui and Babylon, the initiative “seeks to integrate Bitcoin liquidity into the Sui ecosystem, expand the decentralized finance ecosystem by utilizing LBTC as a collateral asset, and encourage Bitcoin holders to engage in additional activities with their Bitcoin through LBTC.”

They stated that LBTC “will become a core asset in Sui’s DeFi ecosystem, enabling lending, borrowing, and trading to unlock Bitcoin’s USD 1.8 trillion worth of liquidity on Sui.”

Cubist, a blockchain developer, will construct infrastructure for the depositing, minting, staking, and bridging BTC to Sui.

Jacob Phillips, Lombard’s co-founder, stated that the $1.8 trillion market capitalization of Bitcoin represents an immense latent potential.

He also stated that Cubist’s objective is to enable “a future in which Bitcoin holders can fully engage in the next generation of onchain finance without sacrificing security or liquidity.”

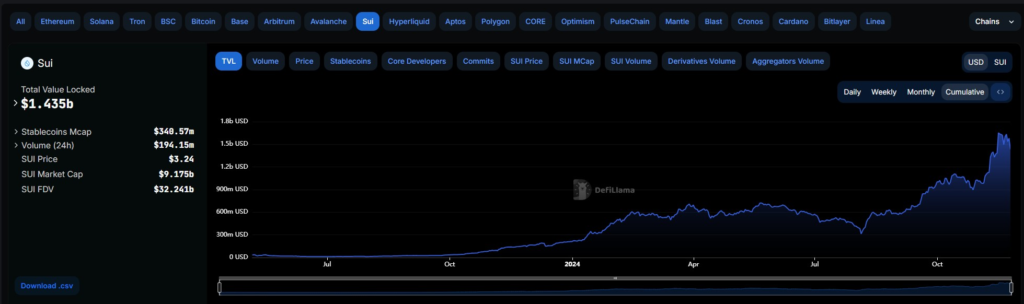

The data provided by DefiLlama indicates that Sui, launched in 2023, has attracted approximately $1.4 billion in total value locked (TVL).

Sui is a high-performance decentralized application (DApp) specialist, earning him the “Solana killer.”

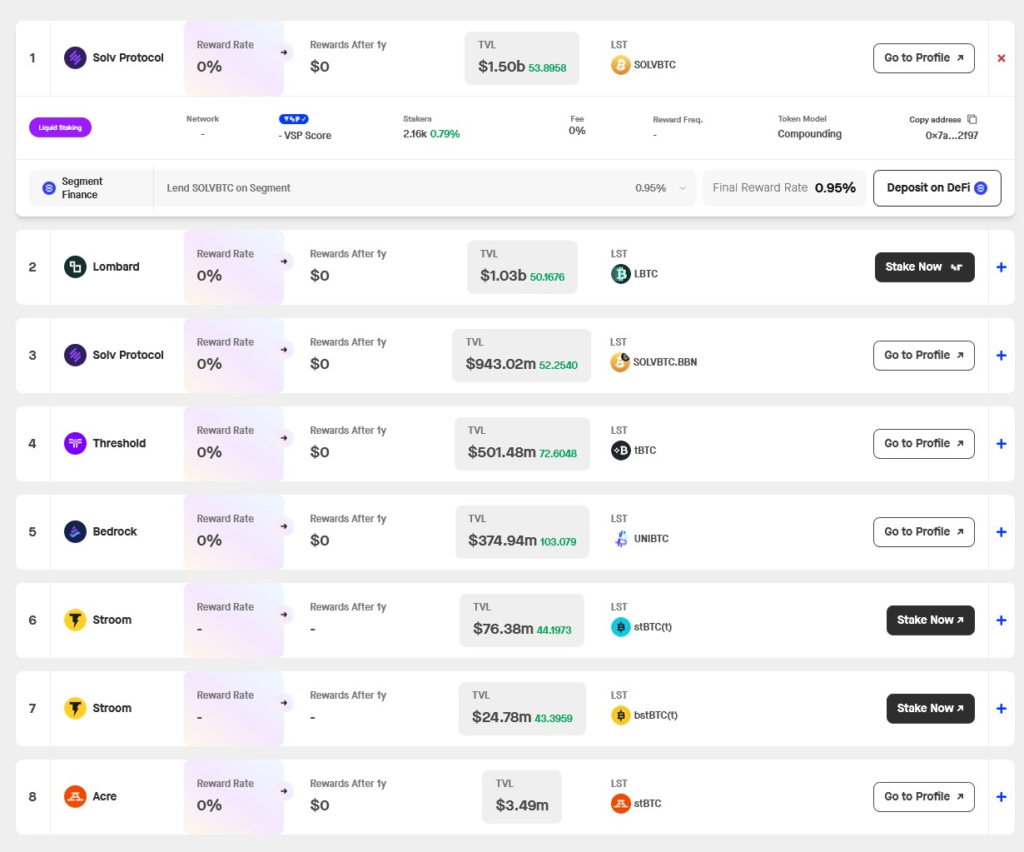

stakingrewards.com estimates that Bitcoin LSTs are worth approximately $4.5 billion in TVL. Solv BTC (SolvBTC) is the most prominent Bitcoin LST, with an estimated $1.5 billion in TV. Immediately following it is Lombard, which has a TVL of approximately $1 billion.

Staked to L2s, such as CoreChain and Babylon, Bitcoin LSTs are tokenized claims on Bitcoin.

Bitcoin L2 stakers, like proof-of-stake (PoS) networks like Ethereum, utilize BTC as collateral to safeguard the networks in exchange for rewards.

The largest LST on Babylon is Lombard’s LBTC, which has yet to begin to distribute staking rewards.

Several other Bitcoin LSTs are currently generating a yield. SolvBTC generates an annualized rate of return (APR) of approximately 1.2% by staking Bitcoin on CoreChain.

Solv Protocol implemented a Bitcoin LST on Solana on October 17 to attract BTC holders amid the proliferation of yield opportunities for the digital currency.