Cathie Wood’s investment fund, Ark Invest, sold the Grayscale Bitcoin Trust’s (GBTC) last surviving assets.

According to Bloomberg analyst Eric Balchunas, ProShares purchased the BITO Bitcoin (BTC) futures ETF in October 2021 with half the substantial $100 million revenues from the GBTC transaction. He proposed that the acquisition of BITO is probably being used as a liquidity bridge mechanism.

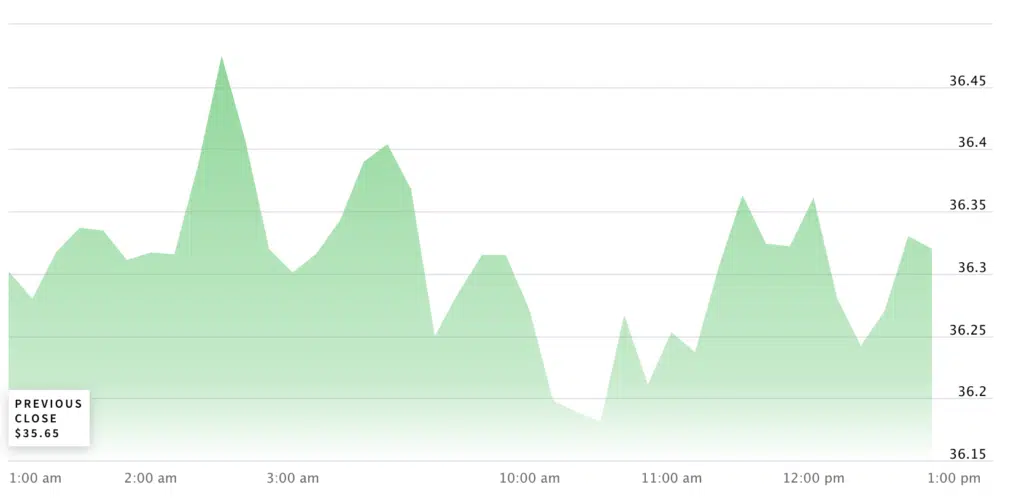

The transaction, however, had no appreciable effect on GBTC shares. As of this writing, the Nasdaq exchange indicates that its trading price is $36.32.

Earlier in December, the business sold off shares of GBTC worth tens of millions of dollars. Grayscale Investments sold 395,945 GBTC trust shares to Ark Invest on December 11, 2023, for a price of $12.85 million.

Then, on December 18, Ark Invest made the largest transaction in the business’s history by selling an additional 809,441 shares of Grayscale Investments’ GBTC Trust from its Next Generation Internet ETF (ARKW) for $27.95 million.

It is possible to see Ark Invest’s most recent portfolio modifications as a preemptive move to put itself in a strong position as it waits for spot Bitcoin ETF approval.

Before January 10, 2024, Cathie Wood, the company’s CEO, believed the funds would be approved. She believes that launching spot Bitcoin ETFs will spur the cryptocurrency’s expansion, particularly if institutional investors become involved in the market.