The maximum extractable value (MEV) bot, which operates on Solana, amassed an astounding $1.7 million from a single dubious transaction involving a trader who acquired memecoin Dogwifhat (WIF) for $9 million “in the most inefficient way possible.”

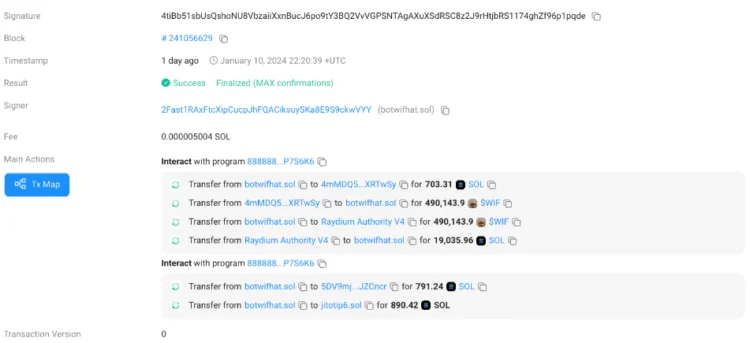

According to Solscan data, the maximum extractable value (MEV) bot, which was operated by 2fast, exchanged 703 Solana for 490,000 WIF and then the same quantity of WIF for 19,035 SOL within the same transaction bundle, generating a $1.73 million profit.

MEV bots are automated programs that automatically identify profitable trading opportunities on blockchain networks and implement those orders.

Jito Labs, the development division of the Jito liquid staking protocol for Solana, supplied the bot with a utility. The application enables bots to bid on transaction bundles and seek maximum extractable value; its operation is comparable to flash bots on the Ethereum network.

This abrupt arbitrage opportunity arose due to a single trader’s transaction—zero trading.sol—purchasing an enormous $8.9 million worth of the meme coin in a single order.

Due to the outsized bid being placed in a low-liquidity pool, the order was fulfilled for approximately $3 per WIF token, an increase of roughly 1,400% over the token’s value. As a result of the transaction’s immediate and subsequent decline, the merchant lost 92% of their funds instantly.

The MEV bot utilized a backrunning strategy that was comparatively straightforward to acquire profits from the trader who executed the WIF order in the most “inefficient way possible,” according to a post by pseudonymous developer Pland on X (formerly Twitter) on January 11.

Backrunning is a form of arbitrage that capitalizes on the potential profit from a significant mispriced transaction without affecting the underlying trade, making it comparatively less detrimental to a blockchain network.

In contrast, the more malicious “sandwich” attacks entail inserting an order between two transactions to recalculate the initial proposal. This often results in a decline in the initial transaction price, which is detrimental to blockchain users.

As a result of the solitary transaction, the price of WIF surged momentarily to $4.

Although the trader is still significantly depleted in funds due to the misplaced order, the enormous candlestick pattern prompted them to resume acquiring WIF. The meme coin experienced a 50% increase in value from the point immediately following the decline.