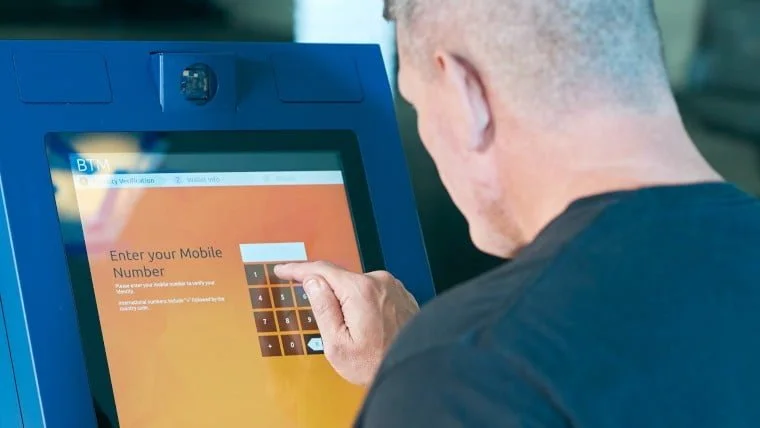

The Financial Conduct Authority (FCA) in the UK has told operators of crypto cashpoints to shut their machines down.

Financial Conduct Authority Shuts Down Bitcoin ATMs in UK

According to a statement made today by the UK’s Financial Conduct Authority (FCA), crypto ATM operators have been advised to take down their machines or risk enforcement action.

The FCA also stated that bitcoin ATMs that provide crypto exchange services must register with the agency and adhere to the UK’s Money Laundering Regulations.

“None of the crypto asset firms registered with us have been allowed to offer crypto ATM services,” the FCA stated. “This means that any of them functioning in the UK are doing so illegally, and consumers should not use them.”

“We are concerned about the operation of crypto ATM machines in the UK and will be contacting the operators to request that the devices be taken down or face further action,” the regulator said.

ATMs, Cryptocurrency, and the Financial Conduct Authority

According to Coin ATM Radar, a website that analyzes cryptocurrency ATMs throughout the world, the United Kingdom now has 81 cryptocurrency ATMs.

More than 50 cryptocurrency ATMs can be found in London, with Birmingham coming in second with nine.

On a global scale, the United Kingdom narrowly misses out on a spot in the top ten countries with the most cryptocurrency ATMs, trailing Romania with 124.

With over 32,000 operating ATMs, the United States is by far the world’s bitcoin ATM leader.

The FCA’s latest warning on cryptocurrency ATMs is the latest in a string of crackdowns on the crypto industry as a whole.

The FCA produced a list of five concerns that customers should be aware of when dealing with cryptocurrencies in January of last year, including consumer protection, price volatility, and deceptive marketing material.

“If customers invest in these types of goods, they should expect to lose all of their money,” the FCA added.

This warning was reinforced by FCA CEO Nikil Rathi in September 2021.

The FCA is also concerned about a number of companies in the cryptocurrency industry, including Binance, the world’s largest exchange.

The regulator previously told Decrypt that it has a “big concern” with Binance’s apparent lack of a headquarters and that Binance’s UK firm was “incapable” of being regulated after it allegedly failed to disclose basic information to the regulator in September last year.