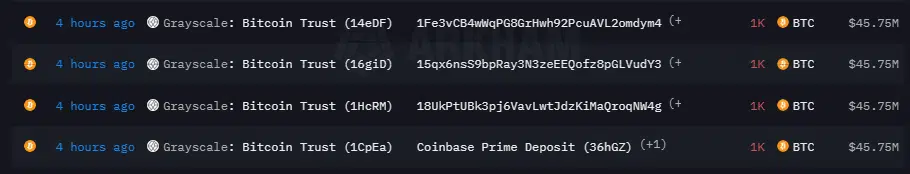

Grayscale Bitcoin Trust sent approximately 4,000 Bitcoins worth $183 million to Coinbase Prime deposit addresses.

The most recent statistics from Arkham Intelligence made this clear. The fee structure of Grayscale’s spot Bitcoin ETF, which is 1.5%, is renowned for being very high. However, investors may be considering other options in light of the SEC’s recent approval of multiple spot Bitcoin ETFs.

More competitive fees, ranging from as low as 0.2% to 1.5%, are offered by other ETFs managed by firms like BlackRock, VanEck, ARK 21Shares, and Bitwise. Some of these even provide introductory waivers.

Significant shifts are occurring in the Bitcoin market itself. In just one day, the price of Bitcoin dropped 5.5% from its peak of over $49,000 to about $43,500 following the SEC’s approval of multiple Bitcoin spot ETFs.

A number of reasons, such as the market’s reaction to the new ETFs and a possible supply shock brought on by significant transactions like Grayscale, could be responsible for this price volatility.

Previous reports from several analysts have also indicated that while the market gets used to these new investment vehicles, substantial volatility in the value of Bitcoin could be expected.