Binance Futures adds a new USDC-margined SUI Perpetual Contract with up to 50x leverage, attracting more traders and investors to the SUI market and driving its price up.

The USDC-margined SUI Perpetual Contract is a new product offered by Binance Futures, the futures trading platform of Binance, the world’s largest cryptocurrency exchange.

The contract allows traders to buy or sell SUI, a decentralized stablecoin backed by a basket of fiat currencies, using USDC, a stablecoin pegged to the U.S. dollar, as collateral. The contract has no expiry date and mimics the spot price of SUI.

The contract also allows traders to leverage their positions up to 50 times, meaning they can amplify their profits or losses by borrowing funds from the platform. The contract also has a low tick size of 0.0001 and operates 24/7, enabling traders to execute orders quickly and conveniently.

The launch of the USDC-margined SUI Perpetual Contract on Binance Futures has a positive impact on the SUI market, increasing the liquidity, accessibility, and attractiveness of the SUI token.

By offering more trading options and flexibility, Binance Futures attracts more traders and investors to the SUI market, creating more demand and supply for the token.

The increased demand and supply, coupled with the leverage effect, can also influence the price of SUI, as seen in the recent price rally.

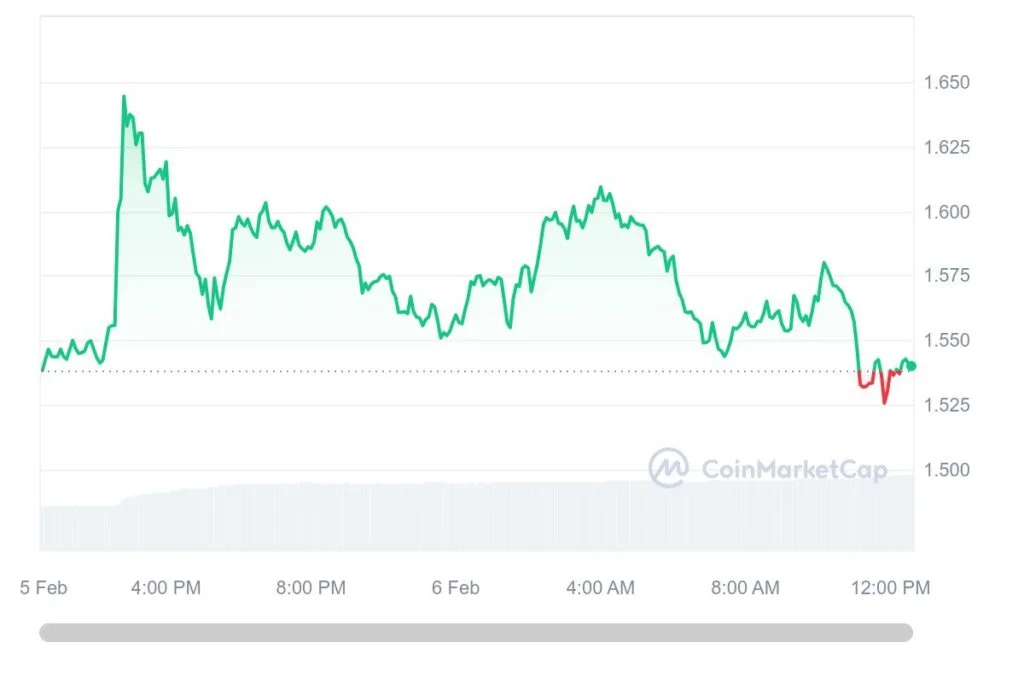

Since the announcement of the contract on February 5th, 2024, the SUI price has risen by 8.33%, reaching a high of $1.65 and a low of $1.53. The trading volume of SUI has also surged by 63.68%, reaching $556.09 million.

Moreover, the contract also benefits from a promotional trading fee discount of 10% until April 3rd, 2024, which encourages more traders to participate in the SUI market and potentially boost its price further.

Trading the USDC-margined SUI Perpetual Contract on Binance Futures can be rewarding but also risky. On the one hand, traders can enjoy the benefits of high leverage, low fees, and 24/7 trading, as well as the stability and security of USDC and SUI.

On the other hand, traders also face the risks of market volatility, liquidation, margin calls, and the regulatory and technical uncertainties of the crypto industry.

Therefore, traders should exercise caution and due diligence when trading the USDC-margined SUI Perpetual Contract and only invest what they can afford to lose. Traders should also familiarize themselves with the contract specifications, trading rules, and risk management tools provided by Binance Futures and seek professional advice if needed.