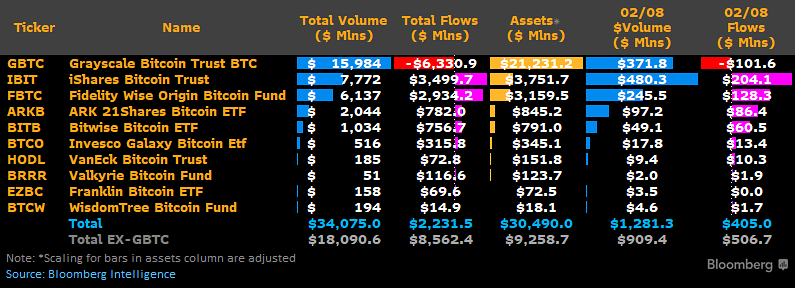

According to the data from Bloomberg Intelligence, GBTC has seen a record outflow of $101.6 million on February 9, 2024. This is the highest outflow since GBTC started trading in 2013 and the first time that the outflow exceeded $100 million.

This also marks a reversal of the trend that saw GBTC outflow slowing down to a record low of $72.7 million on February 7, 20243.

The trend of GBTC outflow suggests that investors are losing faith in GBTC as a spot Bitcoin ETF product and are looking for alternative ways to invest in Bitcoin. This could be due to several factors, such as:

- The high management fee of GBTC is 1.5%, compared to other Bitcoin ETFs that charge as low as 0.25%.

- The persistent discount of GBTC means that GBTC shares trade below the underlying Bitcoin’s net asset value (NAV). This implies that investors are willing to sell GBTC at a lower price than the actual value of Bitcoin.

- The competition from other Bitcoin ETFs, especially the ones that have been approved by the SEC, such as ProShares Bitcoin Strategy ETF (BITO) and Valkyrie Bitcoin Strategy ETF (BTF). These ETFs offer more liquidity, transparency, and regulatory compliance than GBTC.

GBTC outflow does not necessarily have a direct impact on Bitcoin price and the crypto market, as it does not affect the supply and demand of Bitcoin itself. However, GBTC outflow can have an indirect and psychological impact, as it signals the sentiment and behavior of investors towards Bitcoin and the crypto market.

On the positive side, GBTC outflow can indicate that investors are moving their funds to other Bitcoin ETFs or platforms, which can increase the liquidity and diversity of the crypto market. It can also indicate that investors are redeeming their GBTC shares for Bitcoin, which can increase the demand and scarcity of the cryptocurrency.

On the negative side, GBTC outflow can indicate that investors are losing interest or confidence in Bitcoin and the crypto market, reducing the demand for and popularity of cryptocurrency. It can also indicate that investors are selling their GBTC shares for fiat currency, which can increase the supply and inflation of the currency.

The current market data shows that Bitcoin price has increased to over $47,000, with a 4.24% increase in the last 24 hours. This is the highest price level for the cryptocurrency since the SEC approved the first spot Bitcoin ETFs in October 2021. The positive price movement could have been driven by various factors, such as:

- The anticipation of the upcoming halving event in April 2024, which will reduce the supply and increase the scarcity of Bitcoin.

- The increased adoption and acceptance of Bitcoin and the crypto market by institutional and retail investors, as well as by governments and regulators.

- The innovation and development of the crypto and blockchain industry, which offer new solutions and opportunities for the crypto market.

The future prospects of GBTC and the crypto market depend on various factors, such as:

- The performance and popularity of other Bitcoin ETFs and platforms, which can offer more advantages and features than GBTC.

- The regulation and governance of the crypto and blockchain industry, which can affect the security and compliance of GBTC and the crypto market.

- The innovation and growth of the crypto and blockchain industry can create new challenges and opportunities for GBTC and the crypto market.

Some analysts believe that GBTC still has a positive outlook, as it remains the largest and most liquid Bitcoin ETF, with a loyal and diverse customer base. GBTC also has the potential to convert into a spot Bitcoin ETF, which could reduce its management fee and discount and increase its attractiveness and competitiveness.

However, some analysts also warn that GBTC faces significant risks and uncertainties, as it faces increasing competition and regulation and changing customer preferences and behavior. GBTC also has to deal with the volatility and unpredictability of the crypto market, which can affect its performance and profitability.