A substantial sell-off of Grayscale Bitcoin Trust ETF (GBTC) shares, aided partly by the insolvency of FTX, has reportedly impacted Bitcoin’s recent value decline in January 2024, according to a new market report from Bitfinex.

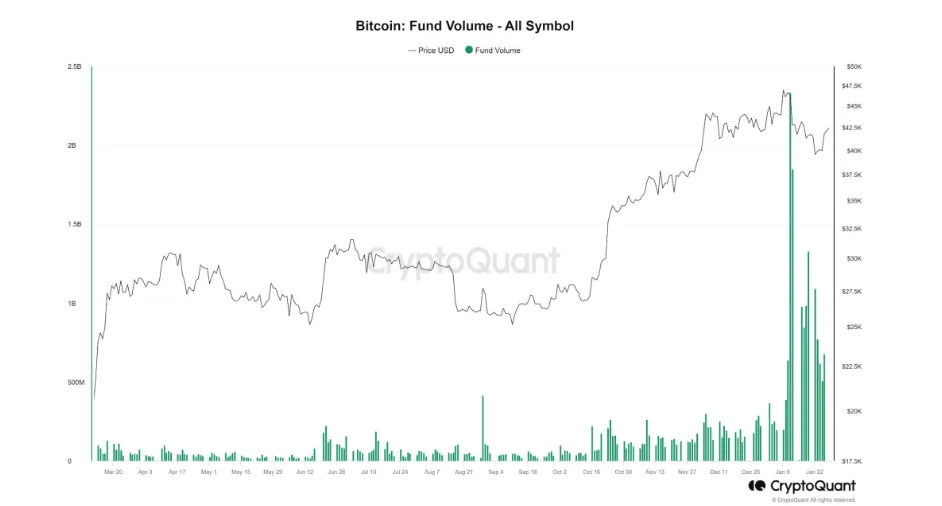

Profits realized after Grayscale’s effective conversion of its GBTC trust to an exchange-traded fund (ETF) had a substantial impact on the market-wide correction that reduced BTC in value from $48,700 to $38,600 in a matter of days, according to an update from Bitfinex Alpha.

The report emphasizes outflows of $4.3 billion after the transformation of GBTC into a spot Bitcoin ETF on January 16. In contrast, BlackRock’s iShares Bitcoin Trust received the highest net inflows (19.82 billion) among individual spot Bitcoin ETFs.

The lack of a fund inflow into the corresponding spot Bitcoin ETF on Saturday, January 20, exemplifies the point at which Bitfinex analysts highlight the influence of ETF flows on the BTC price.

Total assets under management for Grayscale’s GBTC have decreased from $28.6 billion before its conversion from a trust to approximately $24 billion, making it the largest Bitcoin ETF.

The conversion of Grayscale’s trust to a spot Bitcoin ETF facilitated the transfer of substantial shares held by the bankrupt cryptocurrency exchange FTX, according to the Bitfinex report. FTX liquidated all of its holdings of GBTC shares by selling 22 million, or approximately $1 billion worth of shares.

The analysts at Bitfinex Alpha also identify the impact of the commission rates associated with the corresponding Bitcoin ETFs as a significant catalyst for GBTC share sales. According to the report, Grayscale’s competitors presently impose charges varying from 0.2 to 0.9 percent, whereas GBTC maintains its fee at 1.5 percent.

“Investors may be migrating from GBTC to other ETFs due to this higher fee structure,” the source suggests. “TradFi giants, which have more experience managing ETFs, may be particularly appealing to these investors.”

The analysts posit that investors seek more economical means to acquire Bitcoin exposure, influencing the capital movement within the emerging Bitcoin ETF sector. As January nears its conclusion, ETF data indicates that the capital movement among the different ETF funds is stabilizing.