The Central Bank of Sweden, the Riksbank, has published the concluding report regarding its CBDC, the digital Krona pilot program. The report focused on offline functionality and examined the end-user experience.

On March 20, the Riksbank issued its final and fourth report regarding the e-krona. It investigated an offline retail transaction model distinct from the one it had suggested in Phase 2 of the pilot. This model utilized mobile phones to store offline transaction information.

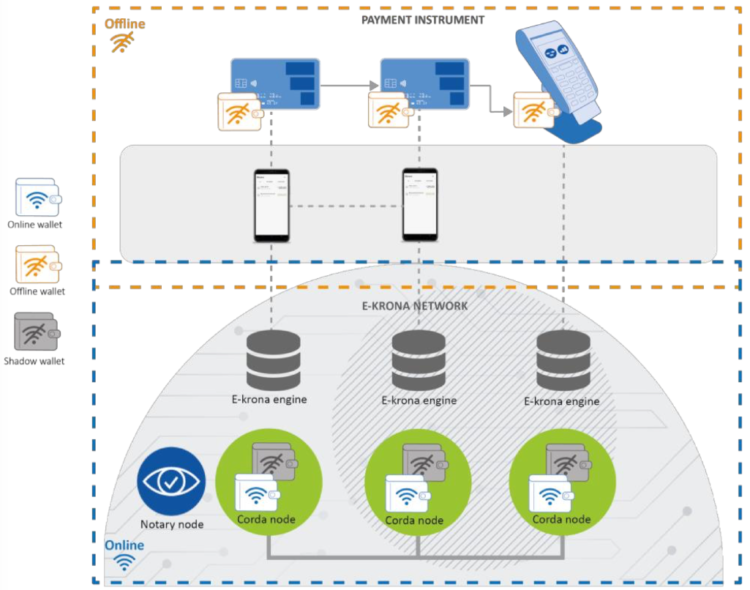

The Riksbank is presently evaluating the implementation of a “shadow wallet” and a payment card (stored-value card) within its online system. Both components were pre-established in the system design. The card would function as the means of payment and monitor remote adjustments to account balances.

The study investigated four distinct use cases: offline transfers between two cards, offline financing and defunding of the payment instrument, setting limits on the balance and number of transactions on a card, and offline payment at a point of sale (POS) utilizing Near Field Communications.

Cards exchanged information and cards communicated with POS terminals. Due to the lack of security consideration for mobile phones as intermediaries in the transaction chain:

“User-to-user payments require many steps to be considered secure, which compromises user- friendliness […] The opportunity to reduce the number of steps is considered small in this design.”

Another challenge that the Riksbank CBDC encounters is the synchronization of payment cards. An unstable synchronization order following a sequence of transactions may render specific shadow wallets illiquid.

Counters would guarantee the correct synchronization order of offline payments. They would also prevent replay assaults, which occur when the same party uses the same electronic currency multiple times.

A report from the Swedish Riksbank examines the possibility of collaborating on retail payments using e-krona.

The card would be equipped with programming that establishes limitations on the quantity and magnitude of offline transactions that can be executed. After modifications in restrictions, the issuance of new credentials would be necessary.

To ensure the security of instructions transmitted between payment cards and the intermediary, R3’s Corda platform, digital certificates were employed. Although the certificates were self-signed, a verified and trustworthy infrastructure was required before introducing the system.

2020 marked the beginning of Swedish e-krona research. The Riksbank has pledged to maintain research on CBDCs if legislation is enacted to implement one.