Nonfungible token (NFT) game platform Munchables announced it had devised a strategy to boost its security and prevent a recurrence of a hack.

An individual known subsequently as the developer of the Ethereum-based nonfungible token (NFT) game Munchables stole more than 17,400 Ether on March 26. The situation de-escalated shortly after the developer returned the stolen funds without requesting a ransom.

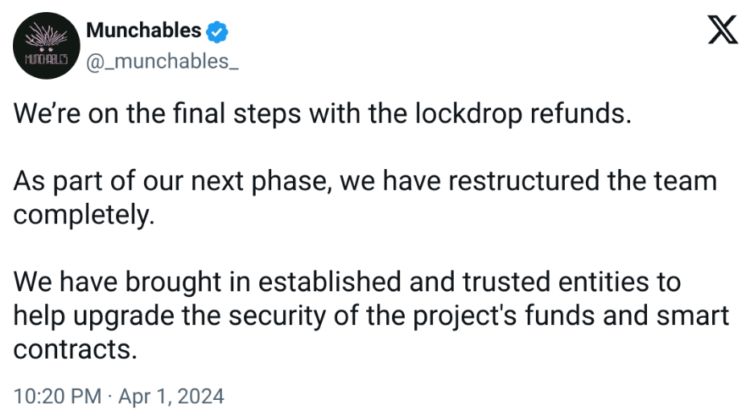

Although Munchables managed to avoid a catastrophic loss, the developer has declared that it is executing several modifications to “enhance the security of the project’s funds and smart contracts.”

To ensure the secure return of user funds, one of the strategies entails the recruitment of market maker Selini Capital, investment firm Manifold Trading, and blockchain investigator ZachXBT as new multisig signatories.

In addition to reauditing and upgrading to new contracts, the company announced that developers from Manifold Trading and Selini Capital will supervise Munchables’ future development recruiting process.

Nethermind, an Ethereum infrastructure company, will conduct a second audit of the updated contracts before resuming Munchables operations.

Returning players will be eligible to receive greater rewards in the game following its relaunch. Additionally, the platform has committed to furnish monetary assistance to the organizations engaged in the recovery endeavors.

“Finally, we will send ETH and future MUNCH donations to those who were involved in the recovery process of keeping our users safe.”

Additionally, users were cautioned against interacting with websites to request a refund, as the funds would be deposited directly into their wallets.

Andreessen Horowitz will invest $30 million in gaming ventures powered by technology.

Nearly $100 million worth of digital assets were compromised in March, according to blockchain security firm PeckShield.

During a month, the cryptocurrency ecosystem was the target of more than thirty malware incidents, resulting in the loss of $187 million in funds. A positive development was the recovery of 52.8% of the compromised funds.

Included among the top five security incidents by the value of the loss is the Munchables incident. In addition, the list included the Curio breach, the Prisma Finance incident, the NFPrompt attack, and the WOOFi exploit.