Ethereum blockchain Network saw significant growth in the first quarter (Q1) of 2024, 155% more than in the first quarter of 2023.

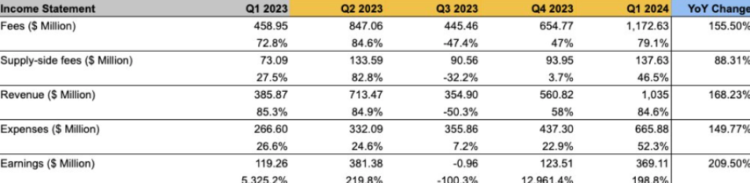

Coin98 Analytics research indicates that Ethereum’s earnings in Q1 2024 tripled on a quarter-over-quarter basis to $369 million. The sum represented a 210% year-over-year growth from $119 million in Q1 2023.

Ethereum’s Q1 2024 revenue and fees grew by 85% and 79% over the previous quarter. The information shows that Ethereum made $1.2 billion in Q1 2024 from transaction fees, a 155% increase from a year earlier.

In Q12024, total Ethereum income reached $1 billion, up 186% from $385 million in the same period the previous year.

Ethereum’s triumph in the first quarter of 2024 coincided with the cryptocurrency’s close-to-all-time high values in March, which caused a sharp increase in network transaction costs.

During the pinnacle of Ethereum’s value in late February, some users claimed to have paid over $100 in transaction fees.

According to some users, the average gas fee for a swap transaction as of March 1 was approximately $79; however, in late February, other users reported that the anticipated cost of an ETH exchange increased by over $400.

Ethereum demonstrated a notable increase in network utilization in Q1 2024, although network users were subject to enormous fees.

In the first quarter of 2024, Ethereum transactions increased overall, rising 8.4% from the previous quarter to reach over 107 million transactions, according to Coin98.

Furthermore, the entire value locked in the decentralized finance ecosystem of Ethereum rose to $55.9 billion, an 86% increase from the previous quarter.

With a 14% increase in market value from the previous quarter, Tether USDT continued to be the largest Ethereum-based, or ERC-20, stablecoin by market capitalization in Q1 2024. Over a quarter, USDC, its most prominent opponent, boosted the market value of ERC-20 by 23%.

A recent analysis by Matrixport indicates that most assets, including those in traditional finance, had a good first quarter of 2024. Nvidia demonstrated returns of 81%, while the Nasdaq had up to 10% returns.

Gold and oil saw 11% and 19% returns during the active trading of commodities. Bitcoin and Ethereum gained 57% and 45% in the first quarter, while US bonds fell in value.