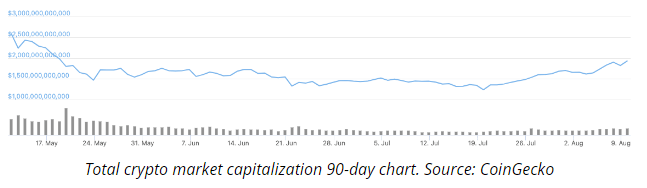

According to statistics from crypto data aggregator, CoinGecko, the total crypto market capitalization value has surpassed $1.9trillion for the first time since May.

In early August, the cryptocurrency market maintained a strong bullish trend, with the total market capitalization approaching $2 trillion.

On August 9, the total crypto market cap surpassed $1.9 trillion for the first time since May 18, according to statistics from crypto data aggregator CoinGecko.

Since July 19, cryptocurrency markets have seen a significant increase, with a market value of approximately $700 billion. The market has lost about $700 billion since reaching an all-time high of $2.5 trillion on May 11.

Major cryptocurrencies such as Bitcoin (BTC) and Ether (ETH) have retested their mid-May market capitalization levels, continuing the robust rebound trend.

According to CoinGecko, Bitcoin’s market value surpassed $860 billion on Monday, the highest level since May 16. Bitcoin experienced a huge sell-off after breaking into the $1 trillion asset category earlier this year, with its market cap plunging to $560 billion as of July 20. The market value of Bitcoin has soared by nearly 53% since it re-entered the $45,000 range.

Since the bear market in July, Ether, the second-largest cryptocurrency by market valuation, has risen about 81 percent from $204 billion on July 20 to $369 billion on Monday.

On Aug. 5, the cryptocurrency experienced a massive network update, with the price of ETH surging 50% following the London hard fork, as investors hoped the upgrade would address issues such as excessive transaction costs.

In the midst of a resurgent bull crypto market, the market capitalization rankings of certain major cryptocurrencies have shifted.

On Aug. 5, Binance USD (BUSD), the third-largest stablecoin in terms of market capitalization after Tether (USDT) and USD Coin (USDC), was pushed out of the top-10 most valuable cryptocurrencies by Uniswap’s governance token UNI.

BUSD is the 11th most valuable cryptocurrency, with a market capitalization of $12 billion, at the time of writing.

As previously noted, the latest rise in crypto markets followed Tesla CEO Elon Musk’s announcement on July 22 that his aerospace firm SpaceX owns Bitcoin.

Tesla’s CEO also stated that due to a considerable decline in the percentage of non-renewable energy needed for Bitcoin mining, the company plans to resume crypto payments for car purchases.

Musk’s prior decision to cease accepting Bitcoin payments at Tesla owing to the currency’s excessive energy consumption was seen as a major factor in the currency’s price drop in May.