Algorand’s (ALGO) price bullish rally approaches $0.31 resistance, with a double bottom pattern indicating a breakout to $1 targets.

Algorand (ALGO) has experienced a bullish rally over the past week, with its price rising by more than 40%.

This surge has sparked speculation among analysts about a potential breakout, raising questions about whether ALGO could soon reach the $1 milestone.

Algorand Price Double Bottom Pattern

Technical analysis of Algorand’s price charts highlights a double bottom pattern that has been forming over the last two years.

This pattern is often seen as a bullish signal, indicating a possible reversal from a downtrend to an uptrend.

Resistance levels have been identified at $0.3097 and $0.3017. Analysts believe that if these levels are surpassed, Algorand’s price could target $1.2668 and $1.1345. Such a breakout would suggest increased bullish sentiment and could drive a sustained rally.

Currently, ALGO is trading at $0.2993 after a 5% price increase in recent sessions, positioning the token just below critical resistance levels and heightening anticipation of a breakout.

Increased Trading Volume and Open Interest

Trading activity around Algorand has seen a significant uptick, with trading volume rising by 55.20% to $466.91 million. This surge reflects growing interest in the asset and enhanced market liquidity.

Open interest, which measures active derivatives market positions, has also increased by 0.41% to $83.27 million.

This indicates traders are maintaining or initiating new positions in expectation of future price movements.

Together, these metrics suggest growing engagement with ALGO, which could lead to increased price volatility in the short term.

Community Governance Updates and Ecosystem Changes

Algorand’s ongoing governance updates may also influence market sentiment. The Algorand Foundation recently initiated a new governance voting period, including a proposal to establish an xGov council.

This council would shift decision-making power from the Foundation to community-elected representatives if approved.

Additionally, the governance model is undergoing changes to phase out incentivized participation rewards, marking a transition in the ecosystem’s operational framework. These updates aim to enhance decentralization and long-term sustainability.

As these governance changes align with broader adoption efforts, they may bolster investor confidence and contribute to the token’s value.

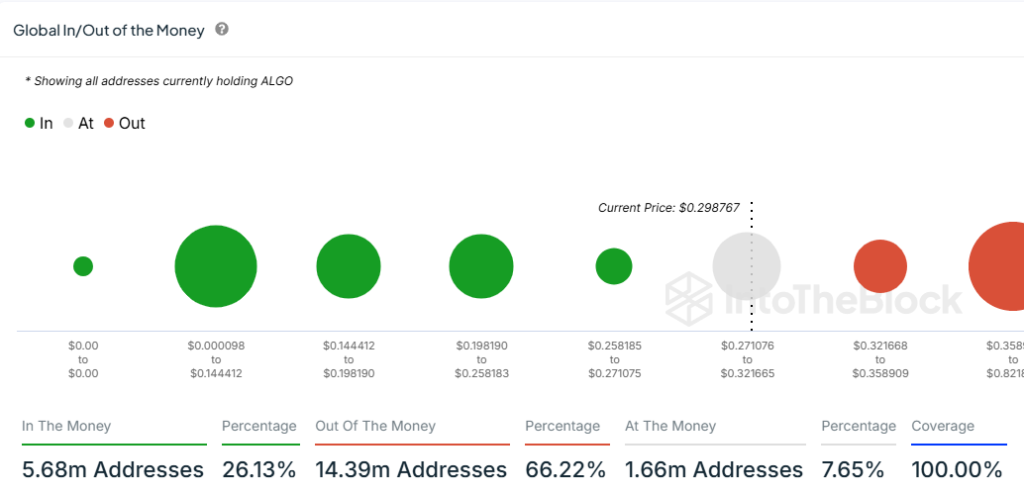

Despite the current price of $0.2993, profitability among ALGO holders varies. Data indicates that 26.13% of holders are “in the money,” having purchased the token at lower prices, while 66.22% are “out of the money,” having bought at higher prices.

With strong support at $0.2851 and resistance at $0.31, ALGO could experience price fluctuations as it approaches these thresholds.

Analysts are closely monitoring whether the price will break through the $0.31 resistance, potentially paving the way for higher targets in 2024.