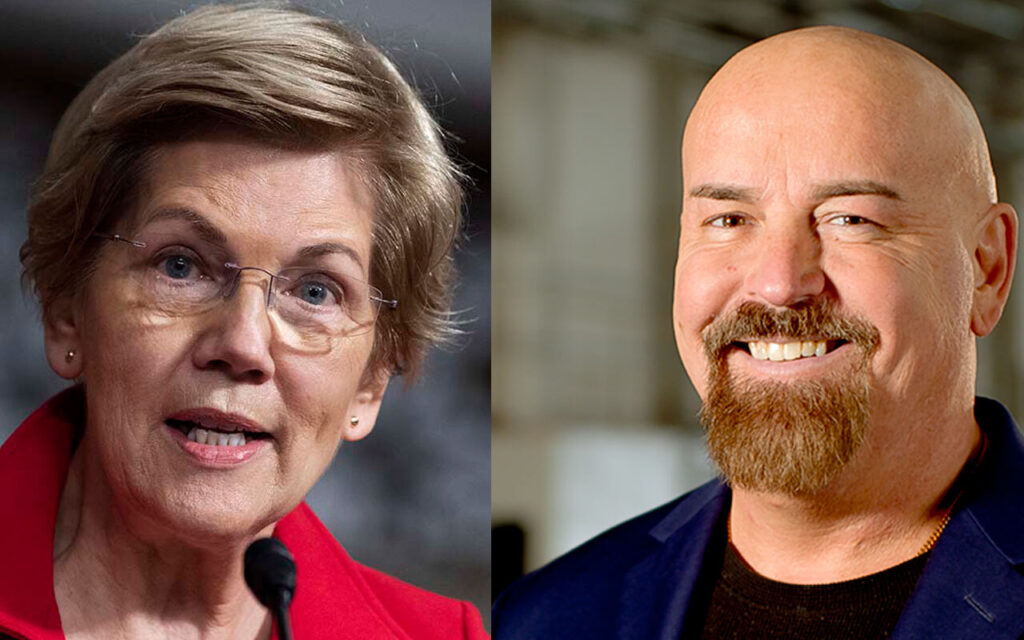

XRP lawyer, John Deaton, opposes Senator Warren’s anti-stablecoin letter to Treasury Secretary, Janet Yellen.

John Deaton, an attorney specializing in XRP, criticized Senator Elizabeth Warren for her recent letter to Treasury Secretary Janet Yellen. The letter articulated apprehensions regarding stablecoins and the possibility that terrorist organizations and renegade nations could exploit them. Meanwhile, Deaton expressed his disapproval via the social media platform X.

John Deaton emphasized the matter as an instance of Senator Warren having misallocated priorities.

“While Massachusetts faces several crises (e.g., illegal immigration, deficit spending, income inequality, soaring inflation, opioid addiction, increased taxation, wealth flight, etc.), Elizabeth Warren is working hard on behalf of the banking industry,” Deaton wrote on X

Furthermore, the proponent of XRP underscored the senator’s alleged disregard for critical domestic matters, including those that impact Steward Hospitals. “Too bad she didn’t pay this kind of attention to matters at home, such as Steward Hospitals,” Deaton continued.

The XRP attorney responded to a post by Alexander Grieve, the Government Affairs Lead at tech investment firm Paradigm. Grieve included images of Warren’s letter to Treasury Secretary Janet Yellen in a post on X.

Grieve wrote, “Senator Warren really ramping up the anti-stablecoin letters. Here’s another one to Treasury Secretary Janet Yellen, calling on her to push for including “nodes in the DeFi system” [sic] in the AML sections of any stablecoin legislation.”

In addition, the XRP attorney has taken a resolute position in the Coinbase vs. SEC litigation. Deaton disclosed in a recent interview with Fox journalist Eleanor Terrett that he intends to advocate for Coinbase by submitting an amicus brief in October. Furthermore, he stated that the action would occur before his Senate campaign.

Senator Warren wrote a letter to Treasury Secretary Janet Yellen on April 16. She urged resolute measures to be taken in response to the perceived menace that cryptocurrencies present to the nation’s security. Senator Warren expressed apprehension in her communiqué regarding the possible exploitation of digital assets, specifically stablecoins, by malicious nations and terrorist organizations.

The correspondence is in response to Deputy Secretary Adewale O. “Wally” Adeyemo’s recent testimony before the Senate Banking, Housing, and Urban Affairs Committee. Deputy Secretary Adeyemo emphasized the necessity for supplementary anti-money laundering (AML) agencies to combat the illicit use of cryptocurrencies throughout the hearing.

Senator Warren’s letter further reiterated the concerns expressed by Deputy Secretary Adeyemo. Furthermore, it underscored the critical nature of implementing preventive measures against malicious actors capitalizing on cryptocurrencies’ decentralized nature and anonymity. Warren, referencing a letter from the Treasury to Congress dated November 2023, advocated for implementing AML/CFT regulations across the entire digital asset ecosystem. Payment intermediaries, such as validators and miners, are included.

Senator Warren said “The pseudonymity of crypto-asset transactions may also lead to financial institutions unknowingly but directly engaging in what may result in illicit financial activity”

Furthermore, she referenced the denial of membership by the Federal Reserve to a state-chartered cryptocurrency bank, which was based on apprehensions regarding possible connections to illicit finance.

In addition, Warren emphasized the dependence of troublesome countries such as Iran on cryptocurrency financing. Furthermore, she cautioned against the potential hazards that could arise from shielding crucial participants in the cryptocurrency ecosystem from regulatory examination. She referenced Iran’s revenue projections from the validation of cryptocurrency transactions. Therefore, advocating for the implementation of rigorous measures to restrict the access of terrorist organizations such as Hamas to digital assets.