Ripple’s CTO, David Schwartz, challenges the belief that Bitcoin’s hash power determines control over its name, sparking discussions on authority in defining Bitcoin.

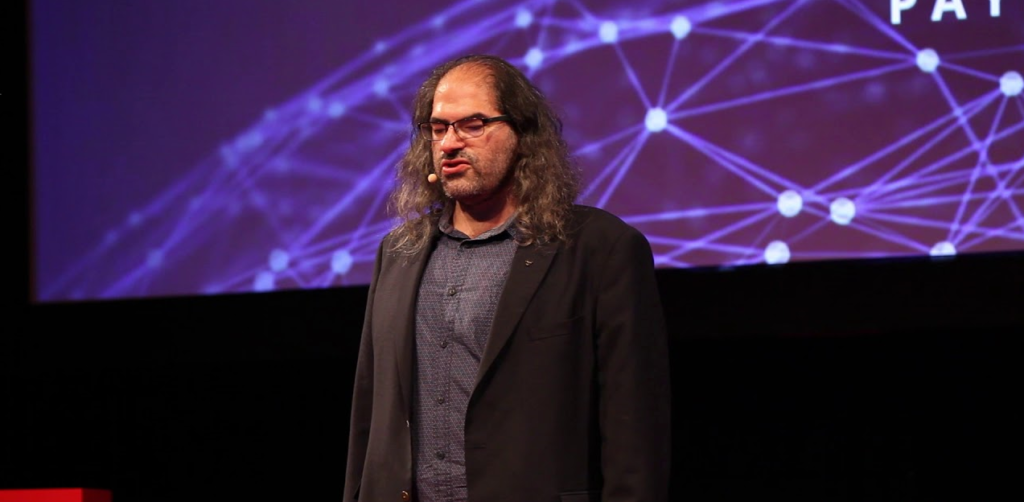

Ripple’s Chief Technology Officer, David Schwartz, has highlighted an issue concerning the centralization of Bitcoin (BTC) hash power. Through his intervention, Schwartz challenges the prevailing notion that the authority to control the name “Bitcoin” is determined by the preponderance of hash power. In his replies to tweets, he challenges the prevailing consensus. He introduces a novel inquiry concerning the jurisdiction that defines the widely recognized cryptocurrency Bitcoin.

The CTO of Ripple questioned whether a logical user would unquestioningly accept anything labeled BTC, irrespective of its integrity, honesty, or qualities. Schwartz placed significant emphasis on the differentiation between what is officially designated as Bitcoin and the desires of its users, implying that the former may only sometimes correspond with the latter’s inclinations.

Hash power, utilized in mining and confirming transactions on the Bitcoin network, has been widely acknowledged as a critical determinant in establishing consensus.

The most extended chain rule is applied to the Nakamoto consensus, which forms the foundation of the Bitcoin network. It states that the chain requiring the most computation time is considered legitimate. Since its inception, this principle has safeguarded the security and integrity of the BTC network.

Schwartz’s critique prompts an inquiry into how hash power enables the construction of the Bitcoin identity. He uses the 2017 Bitcoin Cash hard fork as an illustration to argue that logical users did not instantaneously select the team that claimed to retain the “Bitcoin” name following the fork. This contradicts the notion that the majority of hash power primarily determines the fundamental nature of Bitcoin.

The breach of this operation by Schwartz prompts a reassessment of user conduct within the Bitcoin system. Not only has he made a case for network governance by arguing that proponents of Bitcoin could have labeled it with the letter “Bitcoin” without being able to ascertain whether users hold that view unthinkingly due to the absence of any underlying principle or quality, but other users have also called for a reevaluation. This presentation demonstrates that as the complexity of choice increases, so does the resistance to the network and the selection of Bitcoins.