As a possible rally approaches, Bitcoin anticipates a $42,000 increase following the effective launch of BlackRock’s ETF.

IBIT spot Bitcoin exchange-traded fund (ETF), which BlackRock recently introduced, represents a substantial achievement in integrating cryptocurrencies into conventional finance.

In an interview with Yahoo Finance, Rachel Aguirre, the U.S. Head of iShares Products for BlackRock, discussed the extraordinary success this ETF has attained since its inception.

In its first fortnight of trading, the IBIT witnessed an unprecedented surge in trading volume, which amassed $3 billion. This figure shows the IBIT’s immediate and significant influence on the market.

Increase in Investor Attention

Significant investor attention and trading volume have accompanied the successful introduction of the IBIT ETF. The fund received over $1.6 billion in inflows, demonstrating investors’ increasing demand for cryptocurrency-related products.

Aguirre underscored BlackRock’s dedication to facilitating convenient access to Bitcoin, citing the IBIT ETF as a noteworthy illustration of this approach. BlackRock’s substantial allocation of 16,361 BTC to the ETF demonstrates the firm’s continued faith in the cryptocurrency market.

Simultaneously, Bitcoin (BTC) has demonstrated exceptional resilience. BTC prices have stabilized on the market since the introduction of Bitcoin ETFs in the United States, including BlackRock’s IBIT.

The cryptocurrency experienced a brief increase in value, briefly penetrating $40,527. The observed performance is consistent with a possible bullish trend on the Bitcoin charts, which implies the possibility of a surge to $42,000 if present patterns persist.

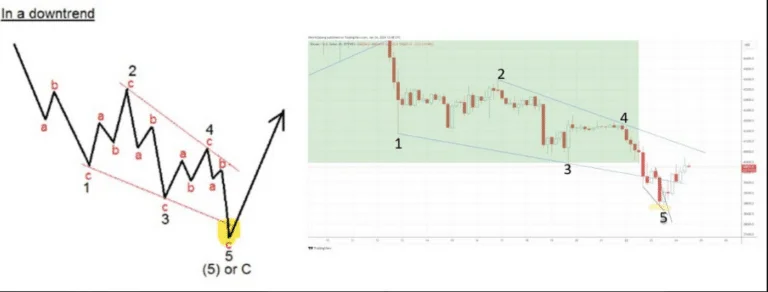

Consistent with the’ sell-the-news’ phenomenon, the cryptocurrency market experienced a brief decline after a speculative surge preceding the approval of Bitcoin ETFs.

Nevertheless, this recent decline of approximately 20% from its peak of $49,021 is moderate in light of previous fluctuations, suggesting that the Bitcoin market is maturing and becoming more stable.

By employing Elliott’s wave theory, market analysts propose that Bitcoin may establish a stable foundation within the price range of $36,000 to $38,000, thereby facilitating the emergence of a prospective upsurge.

In conjunction with historical data, this theory posits that Bitcoin price declines are frequently succeeded by significant upward trends, thereby offering future investment prospects.