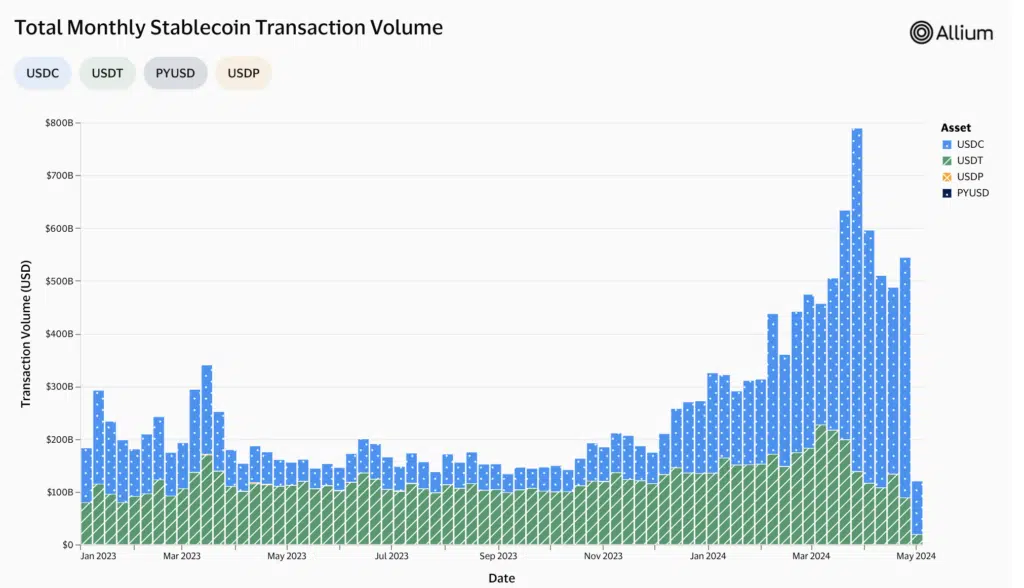

Circle’s USDC stablecoin has overtaken Tether’s USDT in transaction volume in 2024 based on Visa crypto payments data.

Circle’s USD Coin (USDC) has outperformed its biggest rival, Tether (USDT), in terms of transaction volume, according to statistics from blockchain analytics platform Allium Labs and payment giant Visa.

Visa’s analytics indicate that last week’s transaction volume in USDC was $455.5 billion, while USDT barely surpassed $88.5 billion.

Nearly half of the transfers in the stablecoin market since the start of 2024 have come through USD Coin. Previously, USDT—the largest stablecoin by capitalization—always held the top spot.

DefiLlama estimates that Tether’s stablecoin has a 69% market share. Nonetheless, USDC performance suggests that user sentiment may be changing.

According to Bloomberg, which quotes cryptocurrency analyst Noelle Acheson, the shift in the power dynamics could be because USDC is used for everyday transactions in the United States. In contrast, USDT is more frequently utilized abroad as a dollar store of value. Cryptocurrency analyst Noelle Acheson said:

“USDT is more held outside the US as a dollar-based store of value, while the USDC is used in the US as a transaction currency.”

The industry leader in online payments, Stripe, brought back bitcoin transfers last week. On the Solana, Ethereum, and Polygon networks, the platform started to accept USDC.

Issuer Circle has also partnered with BlackRock, the most significant asset manager. At the end of March, the latter introduced its first tokenized fund. Fund clients could exchange BUIDL for USDC on the secondary market with the companies’ assistance.