Shortly after the GameStop stock boom on Wall Street, the entire meme coin industry had a 34% increase in daily trading activity, increasing $5 billion in investors’ wealth.

GameStop Corp (NYSE: GME) is back in action, causing a significant frenzy on Wall Street.

The GameStop (GME) stock price increased by a substantial 75% on Monday, May 13, reaching $30.45. In the aftermarket, the GME stock price surged an additional 21%.

Notably, within the past 24 hours, the GameStop (GME) meme coin has appreciated by an astounding 2200 percent.

Moreover, this has prompted a robust upswing throughout the meme coin industry.

GameStop Rally Triggers 2021-Like Meme Coin Party

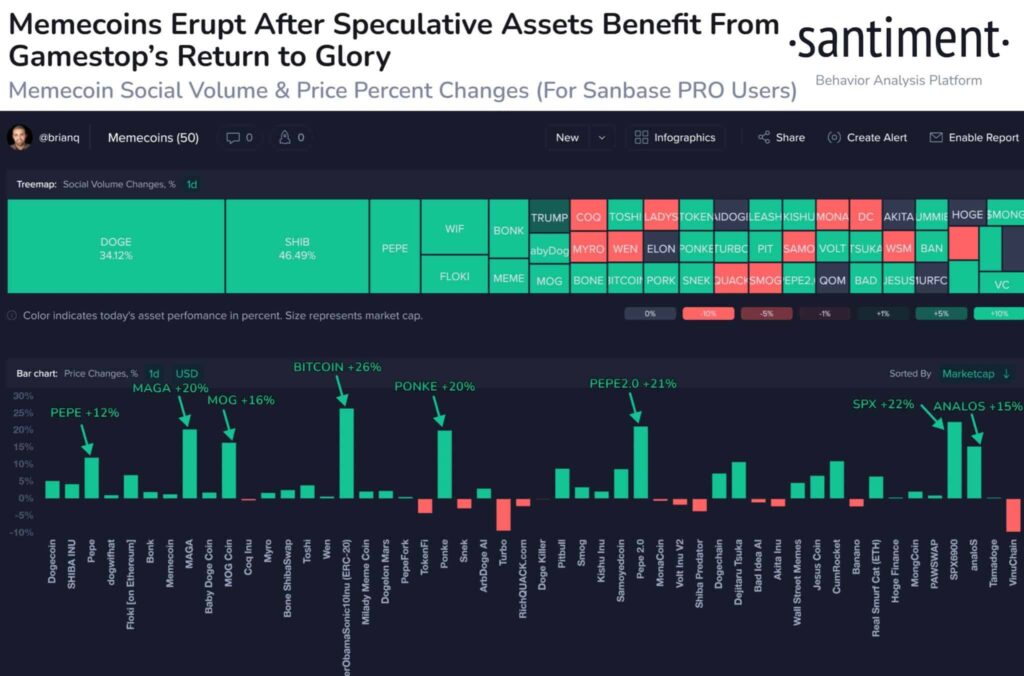

According to Santiment, an on-chain data provider, the meme coin market experienced a noteworthy beginning of the week consisting of breakouts and decouplings within the last twenty-four hours.

The trading volumes of the top 50 assets in the meme coin sector increased by more than 34%.

Moreover, in the past 24 hours, this sector has contributed $5 billion to the fortune of investors. The value of dogecoin (DOGE) has increased by 10%.

Presently, cryptocurrencies such as $ANALOS, $PEPE, $MAGA, $MOG, $BITCOIN, $PONKE, and $PEPE2.0 are generating substantial interest and offer the possibility of significant volatility.

These occurrences underscore the ever-changing characteristics of the memecoin market, which motivates investors to maintain vigilant oversight of these assets.

Short Seller Losses Cross $1 Billion

Keith Gill and other Reddit traders orchestrated an extraordinary reversal of fortune for hedge funds profiting from short positions on a brick-and-mortar game store that they perceived to be ailing during the pandemic of 2021.

In less than a month, this unanticipated surge in support caused the price of GME to increase by more than 1,000%.

The extraordinary increase in the price of GameStop’s shares on Monday caused short sellers to incur losses of nearly $1 billion, according to data from S3 Partners.

According to data provided by S3 Partners, hedge funds engaged in short selling experienced a mark-to-market loss of $838 million in the physical video game retailer GameStop during its 74% surge.

The sudden increase in the stock price looked to be caused by “Roaring Kitty,” who had previously inspired a legion of day traders to buy in the gaming stock in 2021, a historic event in Wall Street history.

Ihor Dusaniwsky, S3 managing director of predictive analytics, said: “Expect short covering in this stock as it already had a 100/100 squeeze score prior to today’s trading”.