PayPal has made its initial foray outside the Ethereum ecosystem by introducing its stablecoin PYUSD on the Solana Blockchain and targeting payment use cases.

A statement published on May 28 states that including PYUSD in the Solana network enables users to conduct transactions at a reduced expense. The effort is to broaden the application of the PYUSD stablecoin as a means of payment for routine and small-scale transactions.

Solana exhibits a transaction throughput of 65,000 per second at a minimal cost of $0.0025, notably surpassing Ethereum’s 15 transactions per second at $50 (USD) during periods of congestion.

An Ethereum transaction may require several minutes to complete, whereas an equivalent transfer executed over Solana could be concluded in under one minute.

“By making PYUSD available on the Solana Blockchain, PayPal advances its mission to enable a digital currency with a stable value optimized for commerce and payments,” said Jose Fernandez da Ponte, vice president of blockchain at PayPal.

Wallet holders of PayPal and Venmo can utilize a chain-agnostic interface, which entails unifying PYUSD balances irrespective of the network that houses the assets.

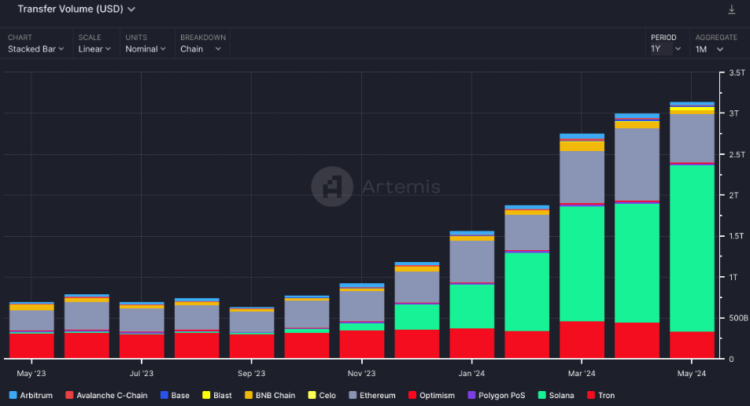

Since the previous year, the Solana network has become the most popular blockchain for stablecoin transfers. Artemis, an analytics platform, reports that the volume of stablecoin transfers on Solana amounted to $1.5 trillion in the preceding year, significantly exceeding Ethereum’s volume of $885 billion during the same time frame.

Additionally, the Solana blockchain encounters obstacles, primarily in the form of recurrent network disruptions. The most recent incident was approximately five hours of transaction downtime on February 9. In the future months, an upgrade known as Firedancer will be released to enhance Solana’s overall dependability and scalability.

Pegged to a more stable reserve asset, typically a fiat currency such as the U.S. dollar, a stablecoin is a form of cryptocurrency that ensures its value remains constant.

In August 2023, PayPal introduced its stablecoin in partnership with Paxos Trust Company. As an ERC-20 token, the stablecoin was initially issued exclusively on Ethereum. U.S. dollar deposits, short-term Treasury bills, and currency equivalents support it.

Currently, Tether USDT commands an estimated 70% market share of the stablecoin sector, characterized by a market capitalization of around $111 billion (DefiLlama data). In contrast, the value of PYUSD stands at $272.96 million.