Co-founder of Animoca Brands and Galaxy Digital, Yat Siu, has tokenized a 1708 Stradivarius violin to secure a loan worth millions of dollars.

Siu reportedly loaned Galaxy an undisclosed sum of money on June 4, collateralizing the loan with the 316-year-old violin that Siu possessed. The digital assets company converted the violin into a nonfungible token (NFT) and will retain the instrument’s physical and NFT versions until Siu repays the loan.

Stella and Siu refrained from disclosing the exact quantity of the loan, but both stated that it was “in the millions.” The violin will be in the custody of a custodian based in Hong Kong until Siu and Galaxy approve its release.

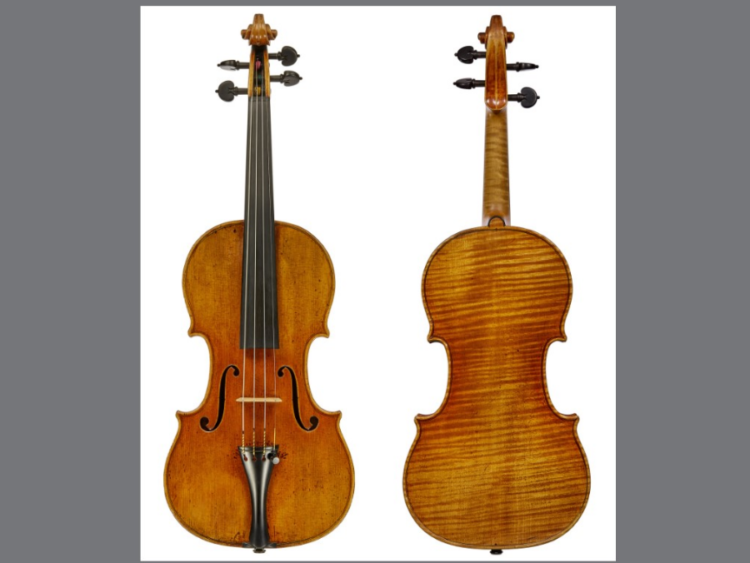

The Stradivarius violin

Catherine the Great, the former Russian Empress, was the former violin owner. A musical instrument auction agency, Tarisio, claims to have recorded the violin’s provenance and can trace its origins over three centuries.

The Russian ambassador to Venice, according to Tarisio, acquired the violin for Empress Elisabeth Petrovna, who ruled the Russian Empire between 1741 and 1762.

Upon her demise, the violin was bequeathed to her successor, Catherine II, more commonly called Catherine the Great.

Siu purchased the violin at auction for over $9 million a year ago.

Asset Tokenization For Financing

According to Galaxy’s vice president of tokenization, Thomas Cowan, the capability to tokenize corporeal assets could alter the crypto lending landscape. Collaterals associated with crypto assets are typically quite substantial due to the volatility of digital assets.

While discussing volatile assets such as Bitcoin or Ether, Cowan stated in an interview with Bloomberg that tokenizing physical assets enables them to lend more to their clients. Although it may be a violin, the executive foresees that it could eventually encompass real estate.

In contrast to utilizing NFTs in physical asset tokenization, digital collectibles experienced a decline in revenue. According to data tracker CryptoSlam, NFT sales volume decreased by 54% in May.

NFTs generated a sales volume exceeding $1 billion in April 2024, whereas in May 2024, the figure dropped to $624 million. The sales of the leading NFT blockchains, Bitcoin, Ethereum, and Solana decreased significantly.