US Representative Michael Collins disclosed a purchase of Velodrome (VELO) after revealing his Ethereum (ETH) investments.

A US politician has made another intriguing crypto bet, shortly after he captivated the cryptocurrency community with a disclosure of his Ethereum (ETH) purchases prior to the United States Securities and Exchange Commission (SEC) sanctioning spot Ethereum exchange-traded funds (ETFs).

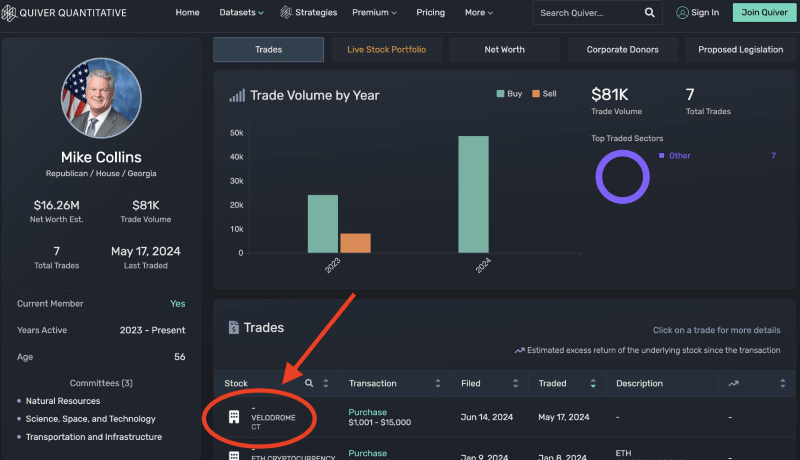

Michael Collins, the US Representative for Georgia’s 10th congressional district, has recently disclosed his acquisition of Velodrome (VELO), a crypto asset with a market capitalization of less than $100 million, as per the data provided by investment research firm Quiver Quantitative on June 17.

In particular, on May 17, Collins acquired a token from Velodrome Finance, an automated market maker (AMM) that serves as the central trading and liquidity center on the Optimism Network (OP).

The company’s objective is to evolve into the next iteration of the Solidly Exchange model, which was developed by Andrew Cronje. The purchase price ranged from $1,000 to $15,000.

Mike Collins disclosed in January 2024 an investment of up to $65,000 in Ethereum on two separate occasions. He purchased between $1,001 and $15,000 on January 3 and between $15,001 and $50,000 on January 8, coinciding with the initiation of the spot Ethereum ETF rumors.

The data shared by the markets analytics platform unusual_whales on January 10 indicates that Collins had purchased this crypto asset three times in 2023, on October 9, November 5, and December 28, in sales totaling $75,000, in addition to his January 2024 purchases.

At the time of publication, the Velodrome Finance token was trading at $0.105, representing a 12.24% increase in the past 24 hours and a 1.44% increase over the previous seven days. However, it was down 24.45% on its monthly chart, as per the data retrieved on June 18.