Binance launched BFUSD, a reward-bearing asset offering up to 19.55% APY and usable as margin in multi-asset mode.

On Tuesday, the largest cryptocurrency exchange in the world, Binance, announced that its reward-bearing asset, BFUSD, has completed its formal launch. The exchange has confirmed that the cryptocurrency asset will provide consumers with returns on qualifying amounts in their futures account, potentially yielding up to 19.55 percent.

Binance, one of the most prominent cryptocurrency exchanges, has introduced BFUSD, a reward-bearing asset, with the intention of offering consumers returns on the qualifying sums that they have in their futures account.

Binance Introduces High-Yield BFUSD Margin Asset

Furthermore, it serves as a margin in the multi-asset mode, enabling the accumulation of incentives. Binance Futures disclosed the introduction of the BFUSD reward-bearing asset in an official release on November 26.

On November 27, at two o’clock in the morning UTC, users will be able to begin purchasing the margin asset. The VIP level of a user determines the limit quota for the margin asset, which the cryptocurrency exchange has established. You will need to transfer USDT to your UM wallet in order to participate.

The only holders who will receive an increased APY are those who traded UM futures the day before. The UM Futures accounts of users will receive interest payments on a daily basis starting from now.

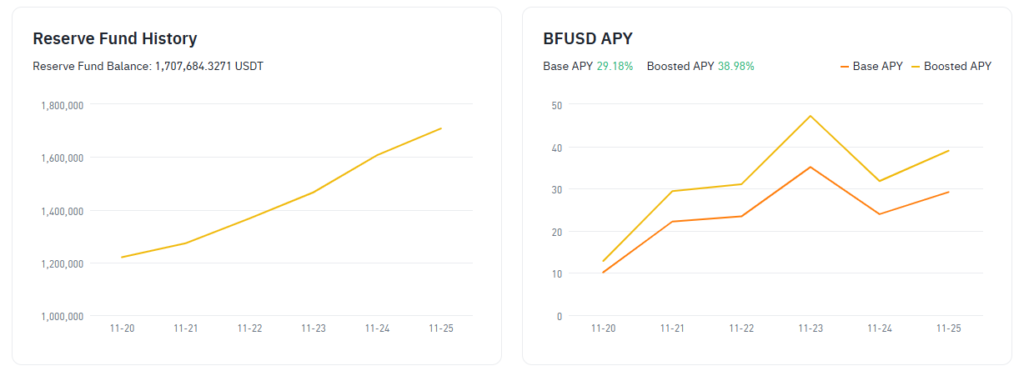

In terms of the collateralized percentage, the supply is 120 million, and the percentage is 101.32%. Binance data indicates that it will provide an annual percentage yield (APY) of 29.18%, with an increased APY of 38.98%. It is possible to exchange BFUSD for the stablecoin USD.

Because users are able to exchange it for the United States dollar, it is an excellent option for those who are looking for a stable solution in the cryptocurrency market.

In addition to this, the exchange has established a BFUSD Reserve Fund with the express purpose of covering any potential costs that may arise from funding DEES, offering support for the upkeep of the Collateral Pool and the Hedging Portfolio simultaneously.

The ability to replace margin when trading USD-M futures in multi-asset mode is one of its most significant advantages. The exchange awards two different reward rates every day, the base rate and the boosted rate.

The exchange will use the revenues from selling BFUSD to implement investment plans that generate passive income. The holding of the margin asset is associated with a number of risks, including negative funding rates and the absence of any right, claim, entitlement, or other interest from the collateral pool, hedging portfolio, or reserve capital.

Additionally, users face exposure to Binance’s credit risk, the potential for redemption failure, and potential costs. Additionally, the exchange has announced an offer that is specific to early adopters. This offer includes token vouchers worth 100,000 USDT and includes no fees at the time of purchase.