India’s FIU has levied an 188.2 million rupee ($2.25 million) fine on Binance for failing to comply with the nation’s Anti-Money Laundering (AML) regulations.

On Thursday, June 19, the agency announced that the penalty applies to multiple violations of the Prevention of Money Laundering Act (PMLA), 2002.

About the case

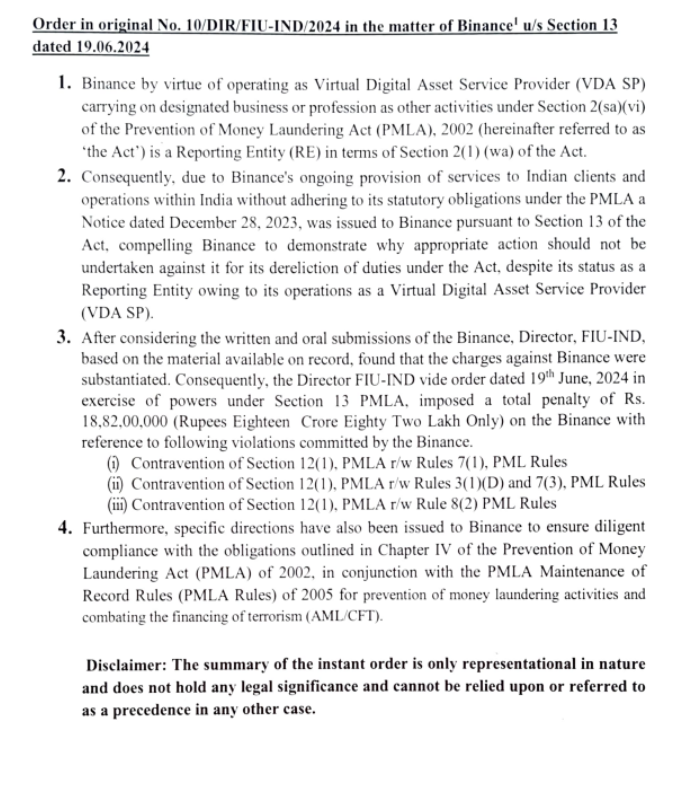

Binance meets the criteria for a reporting entity (RE) under Section 2 (as) (vi) of the PMLA by operating as a Virtual Digital Asset Service Provider. As part of this designation, it is necessary to maintain and report transaction records and implement effective anti-money laundering (AML) measures.

Nevertheless, the FIU’s investigation demonstrated that Binance neglected to fulfill these obligations when offering services to Indian clients. In January 2024, Indian authorities issued show-cause notices to Binance and several other offshore cryptocurrency exchanges, prohibiting them from operating in India due to their “illegal activities.”

In May, Binance and KuCoin were the first offshore crypto-related entities to receive approval from the Financial Intelligence Unit. The approval was contingent upon paying a penalty following a hearing with the FIU.

Regulatory action and violations

Nevertheless, the FIU announcement stated that the allegations against Binance were substantiated after the director’s written and oral submissions were considered based on the material available on record.

The FIU’s sanction against Binance is based on numerous violations, such as the failure to maintain and report transaction records, the failure to provide authorities with the necessary information, and the failure to preserve records by the law.

Binance’s penalties imposed by other nations

The Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) announced in May that it would impose a $4.4 million administrative monetary penalty on Binance for neglecting to register and report numerous large transactions in digital assets.

According to the regulator, Binance neglected to register as a foreign money services business and report digital currency transactions exceeding $10,000.

Nevertheless, the cryptocurrency exchange filed an appeal against the director of FINTRAC due to allegations of noncompliance with AML and Countering the Financing of Terrorism regulations.

Following allegations of tax evasion and money laundering at Binance, Nigerian authorities apprehended two executives in February.