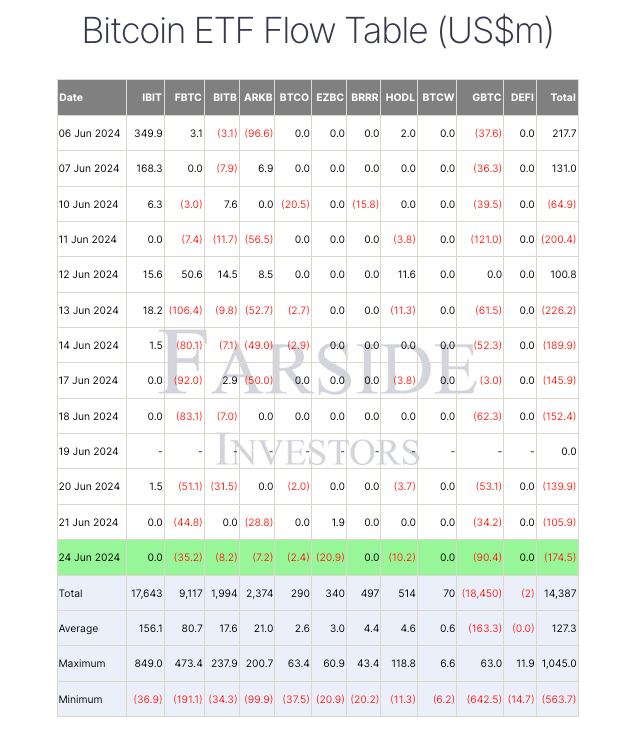

U.S. Bitcoin ETFs saw $1.3 billion in outflows over two weeks amid Bitcoin’s price decline, with Grayscale leading at $517.3 million, per Farside Investors.

Over the last two weeks, $1.3 billion has been taken out of US spot Bitcoin exchange-traded funds (ETFs) as the price of Bitcoin keeps going down.

Farside Investors data shows that $1.298 billion has been taken out of Bitcoin ETFs in the last two trade weeks. Grayscale led the way with $517.3 million in outflows during that time.

Notably, BlackRock’s Bitcoin ETF has been the only fund to do well, bringing in $43.1 million in new money over the last two weeks.

In the same amount of time, Bitcoin’s price has dropped 11.6%, from $69,476 on June 10 to $61,359 at the time this article was written.

The latest outflows from spot Bitcoin ETFs are the worst since April, when they lost more than $1.2 billion between April 24 and the start of May.

Chief Investment Officer at ZeroCap, Jonathan de Wet, explained that the price of Bitcoin will drop to its “key support” level of around $57,000 in the coming weeks as Mt. Gox’s creditors are paid back. He said this while “the bleed continues” across the wider crypto market.

“BTC and ETH are actually holding up surprisingly well given the rest of the market, with key support at 63,000 and 3,400 respectively, and still clearly within the price range over the past few months,” de Wet said.

Many people who talk about the market are worried that there will be a lot of downward pressure in the future. Bitcoin purchases by the German government and nearly $9 billion in BTC Mt. Gox debt repayments that are set to hit the market in July have brought this amount of money in.

de Wet said that even though Bitcoin and other cryptocurrencies are expected to fall even more this week because of buyers being scared off by Mt. Gox’s debt repayments, he is still optimistic about the long term.

“Medium to long-term we are constructive given the ETH ETF launch expected easing bias toward the end of 2024 […] before actual easing in 2025.”

In spite of this, some experts believe that the Mt. Gox creditors’ payments might not have as much of an effect as first thought.

Farhan Badami, a market expert at eToro, explained that Bitcoin prices often change in response to big events in the market.

Badami said that he thinks the price of Bitcoin will level off in the next few weeks and then keep going up until it hits new all-time highs in a few months.

“Within the next few weeks, it’s possible we will be range-bound between $60-70K USD.”