November is closing, and native tokens from various decentralized finance (deFi) protocols are experiencing gains exceeding 50%, pushing DeFi’s total value back to levels last seen in 2021.

Data from the Tie Terminal indicates that tokens issued by Curve Finance, Athena, and Lido have experienced some of the most significant market capitalization gains over the past 30 days among the most prominent DeFi protocols.

CRV has increased by 120.23% over the past 30 days, while ENA, DYDX, and LDO have all experienced increases of 77.6%, 53.7%, and 64.9%, respectively, at this time.

In recent weeks, tokens from PancakeSwap, Uniswap, and SushiSwap have also experienced significant gains: CAKE is up 53.8%, UNI is up 54.7%, and SUSHI is up 57.9%.

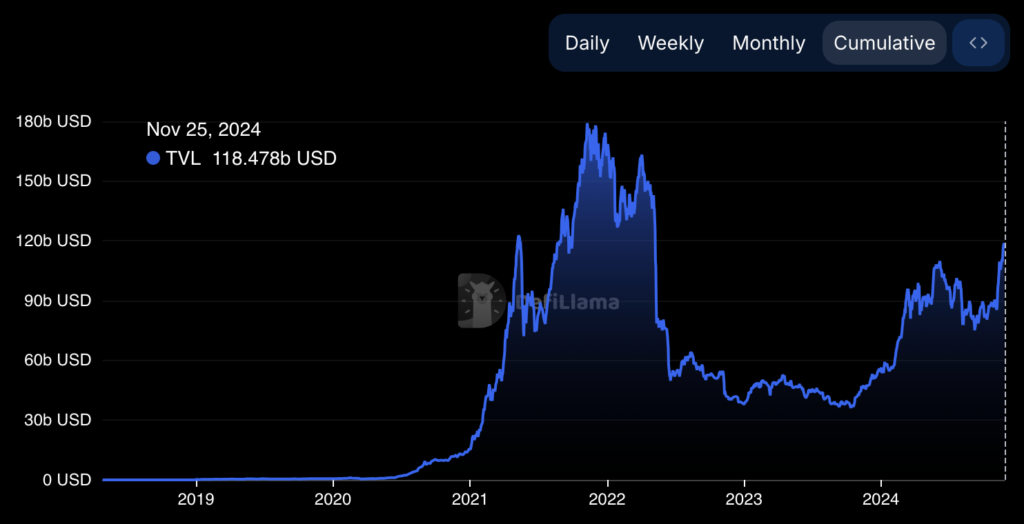

Charts are returning to levels last observed in 2021 due to November’s gains. On Nov. 25, the total value of DeFi protocols was $118.4 billion, the highest level in three years, according to DefiLlama.

Since Donald Trump’s assurance of another term in the White House in early November, DeFi tokens have been adhering to the upward trajectory of crypto assets. Nevertheless, the correlation between the price of altcoins and Bitcoin has decreased recently.

According to analysts from Bitwise, Bitcoin’s market cap dominance has reversed considerably and fallen below 60% between November 18-22. This has enabled the development of more diverse strategies among altcoins.

“We are generally seeing more performance dispersion among altcoins, and altcoins appear to be driven by a more diverse set of investment narratives. In other words, the correlation between major altcoins and Bitcoin has declined significantly, which allows for more alpha opportunities and higher diversification.”

The imminent resignation of Gary Gensler as the Chair of the Securities and Exchange Commission, which was announced on Nov. 21, is the reason for the shift toward altcoins, according to analysts at Bitwise.

As long-term holders are taking profits, the Bitcoin price is still hovering around the 96,000 mark on Nov. 25, failing to surpass the $100,000 milestone.

In the week ending Nov. 22, global crypto exchange-traded funds (ETFs) experienced a record-breaking $3.1 billion weekly inflows, surpassing traditional assets by a significant margin.