Bitcoin demand increased among US investors after the Federal Reserve announced its intention to lower interest rates.

Interest in buying Bitcoin in the United States reached a 39-day peak following recent confirmation from the US Federal Reserve that interest rates are expected to decline, as recent data indicates.

“Bitcoin demand in the US spiked today as the Fed signaled the cycle of lower interest rates will begin,” wrote Julio Moreno from CryptoQuant in an August 24 post on X.

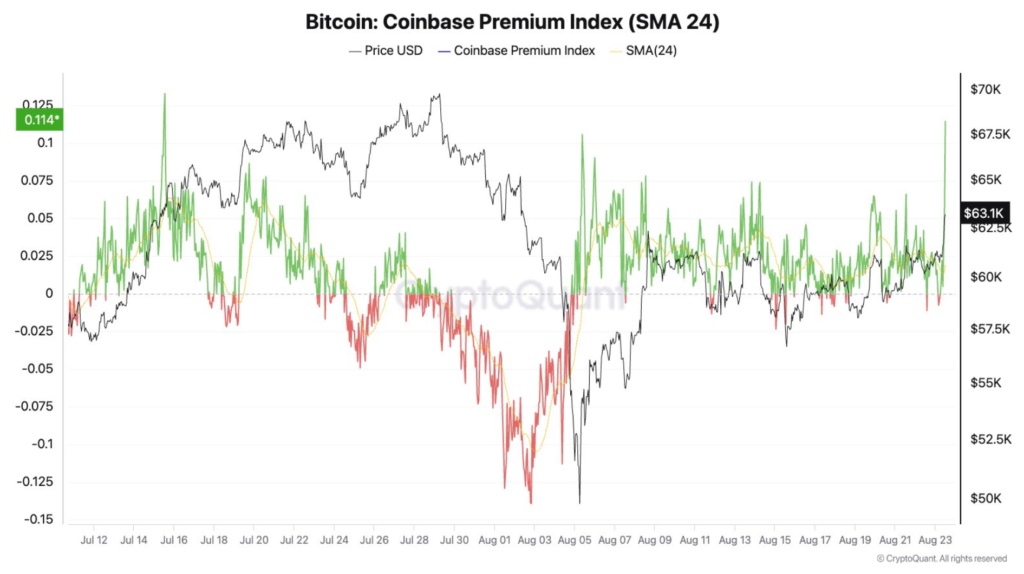

Moreno’s observation was based on the Coinbase Premium Index, which tracks the difference between Bitcoin prices on Coinbase Pro and Binance, measuring US investor demand relative to the global market.

The index reached its highest level since July 15, hitting 0.0114.

While positive values on this index suggest buying pressure, negative values can indicate a sell-off.

For instance, just before “Crypto Black Monday” on August 5, when Bitcoin’s price fell below $50,000, the Coinbase Premium dropped below -0.10.

The rise in demand occurred after Federal Reserve Chair Jerome Powell reassured the public that interest rate cuts were likely, although he did not specify a timeline.

“The time has come for policy to adjust,” Powell said during a speech at the annual Jackson Hole symposium.

As of the time of writing, Bitcoin is trading at $63,978, reflecting a 5.46% increase since August 22, according to CoinMarketCap data.

Bitcoin’s price briefly approached the $65,000 mark, reaching $64,769 — a level not seen since August 2.

Cointelegraph recently reported that Powell’s speech, which markets had closely monitored for signals of policy easing, featured a dovish Powell indicating an “appropriate dialing back of policy restraint,” though he did not provide a specific timeline for when rate cuts might start.

Just hours before the Fed’s announcement and the subsequent rise in Bitcoin’s price, the cryptocurrency was trading around $60,000, with concerns looming about potential selling pressure from miners, given that the cost of mining Bitcoin was $72,224.

Crypto analyst Will Clemente noted in an August 23 post, “there’s still 7 days left in the month, but there’s no denying that the market has seen sub $60k BTC as value for 6 months now.”