This IMF framework emphasizes proactive policy choices, stakeholder engagement, and tailored strategies to enhance CBDC adoption.

A staff member at the International Monetary Fund (IMF) have published a guide that provides policymakers and banking institutions with information on how to increase the adoption of central bank digital currencies (CBDCs) on a global scale.

IMF Publishes REDI Framework For CBDC Adoption

On September 21st, the International Monetary Fund (IMF) published a paper titled “Central Bank Digital Currency Adoption Inclusive Strategies for Intermediaries and Users.”

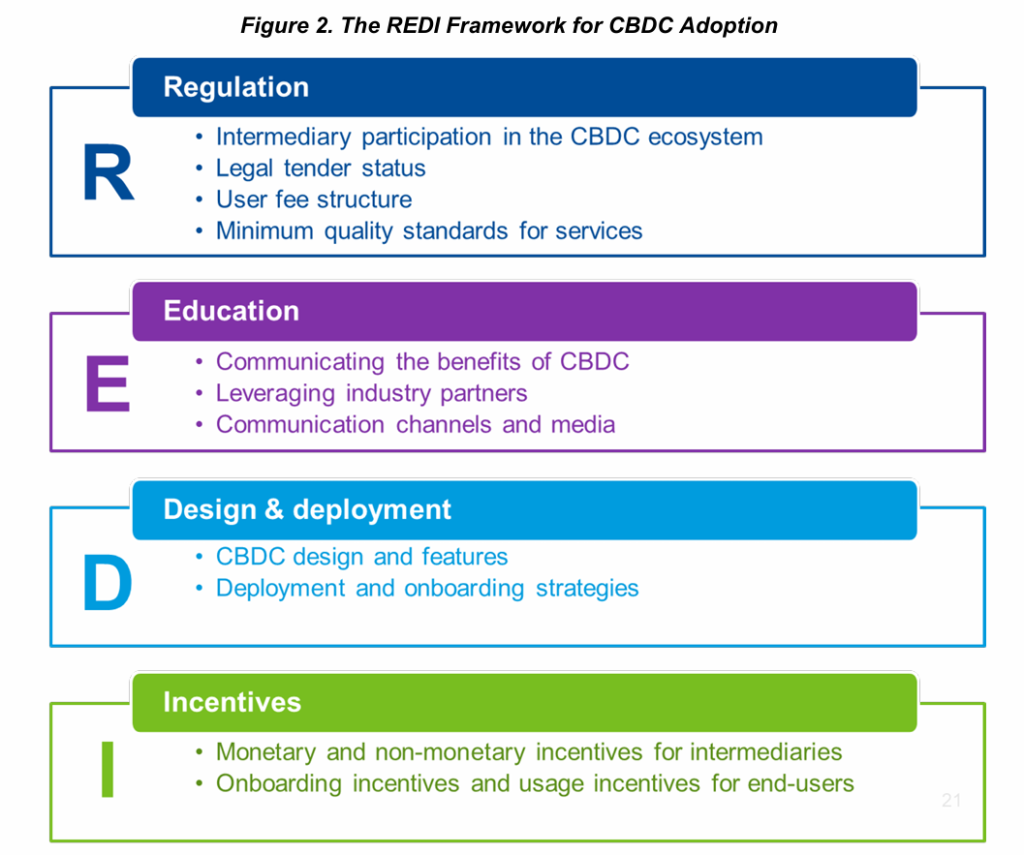

In addition to recommending the implementation of inclusive strategies for intermediaries and end-users, the paper also presented a high-level framework known as the REDI framework to assist in the acceleration of CBDC adoption.

The staff members of the International Monetary Fund believe that in order for CBDC adoption to be successful, proactive strategic policy and design choices that are beneficial to end-users and intermediaries will be required.

Therefore, they urged central banks to focus on stakeholder engagement. The International Monetary Fund (IMF) staff members are responsible for curating the REDI framework, which stands for regulation, education, design and deployment, and incentives.

The purpose of this framework is to help central banks enhance the acceptance of CBDC in their respective countries. The REDI framework revolves around four primary pillars, as previously demonstrated.

The first sub-section, “Regulation,” tasked policymakers with investigating potential regulatory and legislative actions that could foster the adoption of CBDC. The education sub-section recommends developing communication initiatives to raise awareness of CBDC, with central banks serving as a key point of contact.

Thirdly, the article highlighted the need to develop strategies targeted at specific user groups and establish a broad network of intermediaries. The final subsection proposed the implementation of both monetary and non-monetary incentives to encourage the widespread use of CBDCs.

The staff at the International Monetary Fund (IMF) has made a number of recommendations, some of which include subsidizing the costs of setting up a business, transaction fees, and taxes for merchants.

Additionally, the paper encouraged further discussions regarding pre-existing concerns, which included the following:

“Certain policy issues, including sustainability of the CBDC system, ensuring integrity of the system, and balancing adoption with financial stability, will need to be explored further.”

In August, two IMF executives said that increasing the average crypto mining electricity costs globally by as much as 85% through taxes could significantly reduce carbon emissions.

According to the IMF Fiscal Affairs Department’s deputy division chief Shafik Hebous and climate policy division economist Nate Vernon-Lin, a tax of $0.047 per kilowatt hour “would drive the crypto mining industry to curb its emissions in line with global goals.”