Mango DAO has declined the proposal to pay $700,000 to the US Securities and Exchange Commission (SEC) as part of Mango Market’s settlement with the Commission for unregistered token sales.

Realms data indicates that the Mango DAO has declined the proposal to pay the US SEC $700,000 as part of the settlement offer by the DAO, Mango Labs, and Blockworks Foundation.

They recently settled with the Commission, agreeing to pay the sum above and destroy the MNGO tokens in response to the regulator’s charges regarding the unregistered sale of these crypto assets.

The intended purpose of the proposal was to authorize the DAO representative to release the funds presently in escrow ($669,684) to the SEC to satisfy the amount due against the DAO under the settlement terms.

The proposal was unsuccessful because an additional 52.2 million “Yes” votes were required to enact it. The proposal received a mere 27,774,65 affirmative ballots.

It is intriguing that Henry, a smart contracts developer, disclosed in an X post that the proposal was cruising to success with more than 100 million ballots in favor. Nevertheless, electors withdrew 80 million of the notes five hours before the end of the voting period.

Crypto Com’s decision to file a lawsuit against the US Securities and Exchange Commission (SEC) coincides with this development. The exchange stated that the lawsuit was in response to the Wells Notice it received from the Commission, which alleged that it had violated securities laws.

Nevertheless, whether the DAO’s decision to vote against the proposal was influenced by the Crypto Com’s decision to fight back against the SEC is questionable.

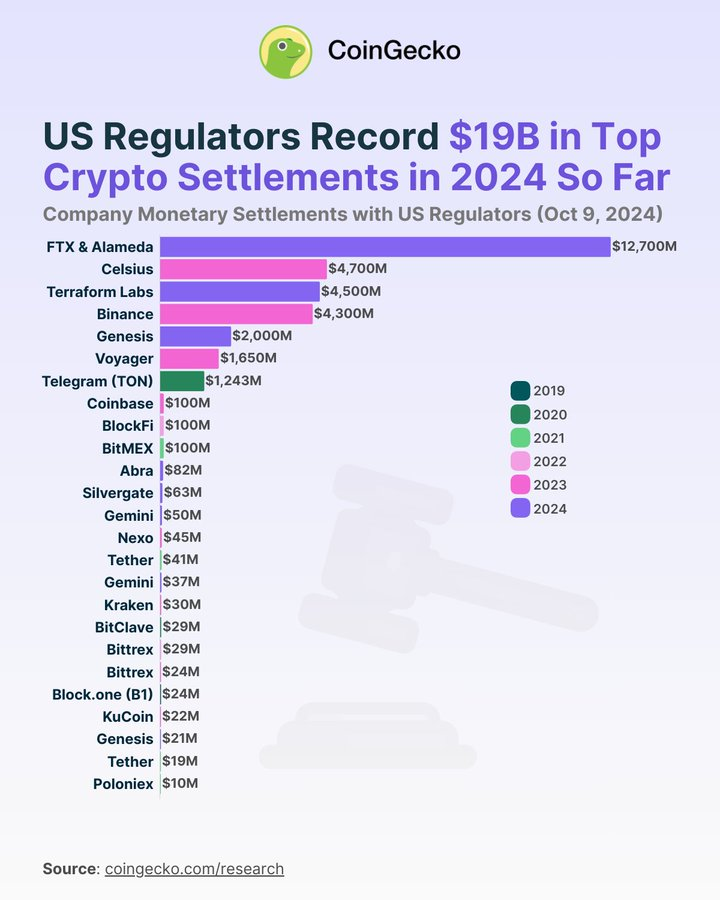

Crypto Settlements by US Regulators

Due to their enforcement actions, the US SEC and other US regulators have reached numerous settlements with crypto firms. Crypto companies have reached settlements with these US regulators totaling $32 billion, according to a CoinGecko report.

The greatest settlement with the US Commodity Futures Trading Commission (CFTC) is the $12.70 billion agreement between FTX and Alameda. These defunct crypto firms’ customers and fraud victims consented to repaying this quantity.

In the interim, the second largest crypto settlement is the $4.7 billion sanction the US SEC imposed on the bankrupt crypto lender Celsius. Immediately following this, Terraform Labs reached a civil settlement with the SEC for $4.3 billion earlier this year.

This year, the US SEC and other regulators have registered $19 billion in top crypto settlements, according to CoinGecko.