According to a recent report, major decentralized exchange (DEX) Uniswap has been in talks with NFT lending protocols to raise funds to further develop its decentralized finance (DeFi) capabilities.

According to a Sept. 30 TechCrunch story, Uniswap Labs, a DeFi firm that contributes to the Uniswap Protocol, is in discussions with a number of investors to fund an equity round of $100 million to $200 million.

According to the story, which quotes two unnamed people familiar with the situation, the business is collaborating with investors including Polychain and one of Singapore’s sovereign funds as part of the future investment round.

The parameters of the agreement could alter because the discussions surrounding the round have not been resolved, but Uniswap would reportedly be valued at $1 billion.

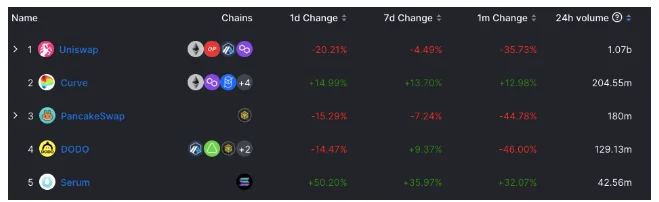

According to reports, the new money will enable Uniswap to offer more nonfungible token (NFT) and DeFi technologies. According to data from DeFi Llama, at the time of writing, Uniswap’s daily trade volumes total $1.1 billion, or nearly 57% of all trading across all worldwide DEXes. Curve, the second-largest DEX by volumes after Uniswap, has daily volumes of roughly $205 million.

According to reports, Uniswap Labs COO Mary-Catherine Lader stated, “Our objective is to enable universal ownership and exchange.” “Embedding the opportunity to swap value and having individuals join the community and exchange value with your project, your company, or organization is a tremendous method to allow more people to partake in this ownership,” she continued.

As Cointelegraph previously reported, Uniswap has been in contact with a number of NFT lending protocols in an effort to realize ambitious plans to address liquidity difficulties and the “information asymmetry” surrounding NFTs.

Despite the bad market, the Ethereum-based DEX has seen growth this year; nevertheless, in July, it was seriously compromised, and the attackers made off with at least $4.7 million worth of ether (ETH).

Founded in 2018, Uniswap closed its first fundraising round from the American investment firm Paradigm, which specializes in cryptocurrencies, in 2019.

Additionally, the company completed a Series A capital round in 2020, which was also headed by Andreessen Horowitz and included contributions from other companies including Paradigm, USV, Version One, Variant, Parafi Capital, and others.