According to an IOSCO report, crypto ownership among retail investors has surged since 2020, with some jurisdictions reporting up to 30% ownership. The organization emphasizes the need for more investor education in response to this rapid growth.

The Board of the International Organization of Securities Commissions (IOSCO) has called for increased investor education regarding cryptocurrency since 2020, citing a substantial increase in crypto ownership among retail investors.

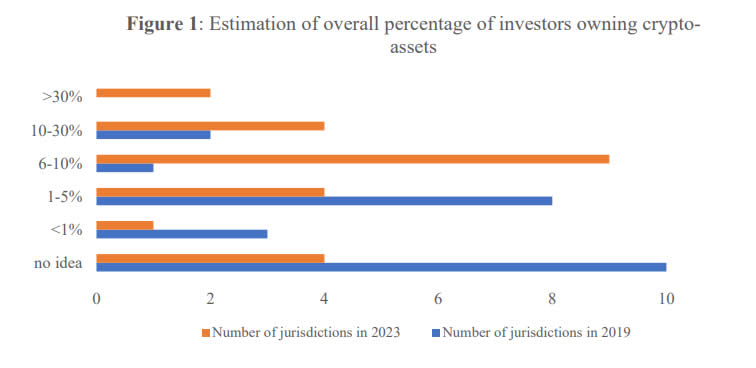

According to an IOSCO report released on October 9, fifteen of the 24 jurisdictions that were surveyed reported that up to 10% or more of retail investors owned crypto last year, while six jurisdictions reported up to 30% or more crypto ownership.

This represents a substantial increase from 2020 when half of the responding jurisdictions estimated that between 1% and 5% of investors owned crypto.

“The crypto-asset space has continued to evolve since 2020,” stated IOSCO.

“Retail investors in both advanced economies and emerging market jurisdictions continue to invest in the crypto-asset market, despite the market’s volatility, which experienced a significant downturn during the 2022 ‘crypto winter.'”

IOSCO stated that there are ongoing risks and concerns regarding the volatility of the crypto market, the lack of investor understanding, the absence of regulations, and the prevalence of scams and deception.

It observed that these concerns were consistent with those identified in the 2020 report.

The report also emphasized the need for more robust investor protection and education measures, as the crypto market has suffered from increased risks and challenges since 2020.

In the cryptocurrency sector, there have been numerous high-profile failures and bankruptcies, a protracted bear market that has seen markets plummet by 73% from their previous highs, and a significant increase in scams, breaches, and investor losses over the past four years. Heightened regulatory and enforcement actions have accompanied these events.

Retail investors continue to exhibit enthusiasm for crypto assets, despite this, according to IOSCO.

“Over the last four years, numerous surveys, studies, and reports have found increasing interest by investors, particularly new investors, in crypto-assets.”

For instance, in the United States, nearly three-quarters of investors under the age of 35 were considering investing in cryptocurrency, while more than half had already done so.

According to the report, approximately 44% of the Gen Z cohort in the United States, which comprises individuals aged 18 to 25, initiated their cryptocurrency investments.

IOSCO also observed that investors who are new to the market are more inclined to invest in crypto than established investors.

According to IOSCO’s report, fear of missing out (FOMO) or speculation, minimal cost of entry, and advice from friends and social media were the primary motivations for investing in crypto.