The Reserve Bank of India (RBI) has revealed concerns regarding the potential impact of artificial intelligence on financial stability, joining other significant monetary authorities in raising red flags.

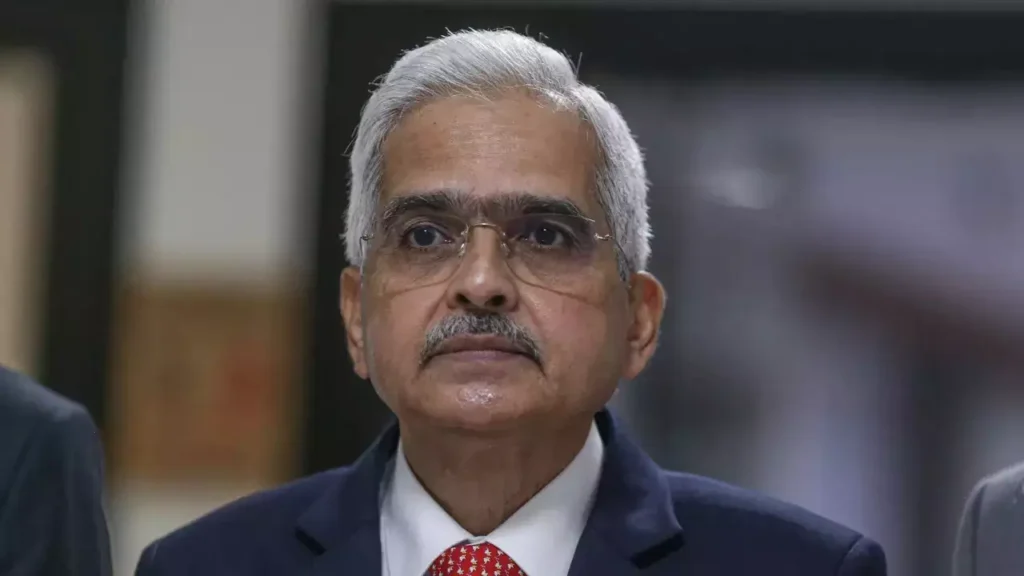

According to a report by Reuters, RBI Governor Shaktikanta Das emphasized the potential hazards associated with the increased utilization of AI and machine learning in financial services during an event in New Delhi on October 14.

AI concerns at the Indian central bank

Das emphasized the concentration risks that could result from the dominance of a few large technology providers. These could manifest as systemic risks if AI systems malfunction or experience industry-wide disruptions.

Das cautioned that AI, besides enhancing customer service and reducing costs, presents additional vulnerabilities, such as the challenge of auditing opaque AI-driven algorithms, data breaches, and increasing intrusions.

Das’s concerns are consistent with those of other global financial institutions.

In its July report, the European Central Bank (ECB) expressed its apprehensions about the potential impact of AI on financial stability.

The European Central Bank (ECB) stated that while AI does “bring benefits to the table,” “operational risk, market concentration, and too-big-to-fail externalities may increase” when AI suppliers are excessively concentrated. The tools are extensively utilized in the financial sector. In addition, it included:

“Widespread AI adoption could heighten the potential for herd behaviour, market correlation, deception, manipulation and conflicts of interest.”

It also cautioned that the widespread adoption of AI could result in inflationary pressures, market manipulation, and herd behavior.

One of the examples provided is the increased demand for energy on a global scale due to the computational capacity necessary to support AI, which in turn drives up energy costs.

Challenges of AI on financial stability

Even more recently, on September 20, the Central Bank of Canada issued a brief regarding its financial instability and AI apprehensions.

“AI adoption could also lead to financial stability issues,” it reported, particularly as “banks and financial institutions are investing in AI to improve customer service, to enhance compliance and risk management, and to assess credit and liquidity risk better.”

Nevertheless, it also foresaw the concentration of operational hazards in a small number of third-party service providers, which would then disseminate throughout the entire financial system:

“The predictive ability of AI can deteriorate unexpectedly, suffer from hallucinations or be biased and discriminatory. And AI makes everything move faster, which could amplify severe market runs and herding behavior in times of market volatility.”

Central banks and financial regulators worldwide are advocating for collaboration among financial institutions, regulators, and technology developers to mitigate these risks and ensure the long-term stability of the global economic system as AI continues to infiltrate the financial sector.