Since 2023, Solana’s SOL token has outperformed Ether by about 600%, becoming a significant competitor to Ethereum.

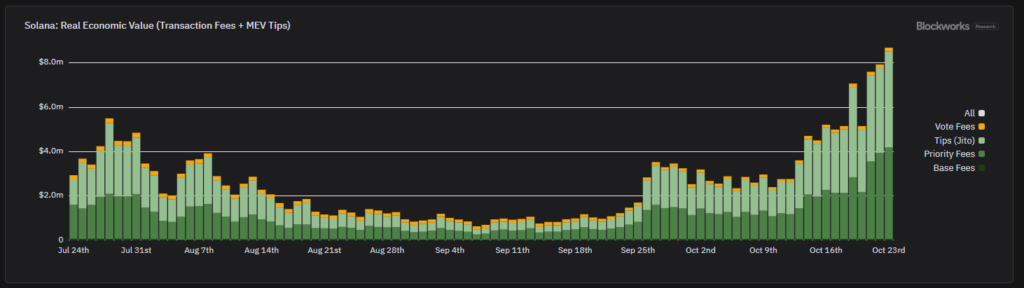

Blockchain technology at the layer-1 level Blockworks Research provided information that Solana once again achieved record-breaking network revenues, having previously reached an all-time high on October 22.

In a post on the X platform, Blockworks’ data analytics manager Dan Smith stated that Solana generated over $8.7 million in economic value from network activity on October 23. This figure represents an increase from the previous day’s worth of just under $8 million.

Blockworks’ research includes all revenue sources, including basic fees, priority fees, and tips, among others. With the SOL token surpassing Ether by about 600% since 2023, Solana has emerged as a significant competitor to Ethereum for the cryptocurrency market.

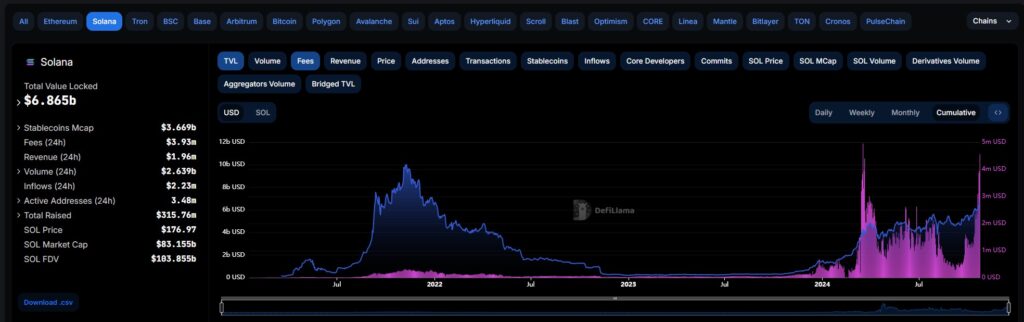

According to information provided by DefiLlama, the total value locked (TVL) on Solana increased from less than $250 million at the beginning of 2023 to more than $6.8 billion as of the 24th of October. For the first time, Solana beat Ethereum in terms of weekly total fees in the month of July.

According to Blockworks Research, Solana generated around $25 million in weekly revenue, which was significantly higher than Ethereum’s $21 million. Pump.fun and Moonshot, two Solana-based memecoin sites, have seen a frenzy of celebrity coin trading, which has significantly contributed to Solana’s rise to prominence.

In the meantime, SOL is being considered for inclusion in exchange-traded funds (ETFs) in the United States, second only to Bitcoin and Ethereum in terms of its potential for inclusion. On October 21, the Solana-based decentralized exchange Raydium outperformed the Ethereum network in terms of revenue in a single day.

DefiLlama’s data on daily revenue from protocol fees shows that Raydium generated $3.4 million in fee revenue during the day, whereas Ethereum generated $3.35 million. The protocol fee revenue provided this information. The network’s Dencun upgrade in March reduced transaction fees by nearly 95%, which caused Ethereum’s revenue to decrease significantly.

Ethereum is still in the process of rebounding from this dip. Matthew Sigel, who is the head of digital asset analysis at VanEck, stated in September that the Ethereum network is on track to create up to $66 billion in annual free cash flow by the year 2030.

Ethereum processed about four trillion dollars’ worth of settlement value in the previous year, and it processes another five trillion dollars’ worth of stablecoin transactions annually. Therefore, this is significantly more significant than PayPal, and it is starting to approach networks such as Visa,” Sigel explained.