Solana prices fall as whales withdraw 139,000 SOL, signaling bearish trends and likely support at $130 amid market volatility.

Solana (SOL) price has seen a significant drop as large holders, or “whales,” have started to unstake a considerable amount of SOL tokens.

This has led to increased market volatility and a bearish trend, raising concerns about the future direction of the token’s value.

Solana Price Declines As Whales Unstake 139,000 SOL

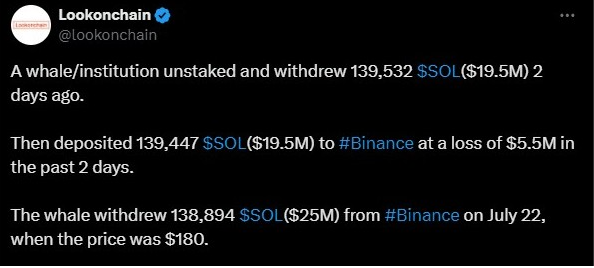

According to on-chain data tracker Lookonchain, a whale recently withdrew 139,000 SOL tokens, causing heightened concerns over the stability of the asset.

This action coincided with a sharp drop in Solana’s market price, which fell from recent highs of around $161 to about $137.

Moreover, this isn’t an isolated event; historical data shows a pattern of similar large-scale unstakings that align with price drops.

The recent activity by whales fits a broader trend where large holders are reducing their positions in response to unfavorable market conditions.

This has resulted in a sudden influx of SOL tokens into various exchanges, possibly in preparation for a sell-off.

Market Response and Technical Analysis of SOL Price

After the whale’s withdrawal, Solana’s price struggled to stay above key technical support levels.

Analysis reveals that the price broke through a significant resistance line that has historically offered substantial support during bullish trends.

Additionally, technical indicators point to increased selling pressure and a possible continuation of the bearish trend.

For example, an analysis of the Moving Average Convergence Divergence (MACD) on the daily Solana price chart shows that the MACD line is below the signal line, indicating bearish momentum.

The histogram, which represents the gap between the MACD line and the signal line, is displaying increasing bearish bars, suggesting that selling pressure is intensifying.

This bearish trend indicates that traders may be growing increasingly pessimistic about Solana’s short-term price prospects.

Beyond these technical challenges, the cryptocurrency market is entering a period of heightened volatility as it nears the end of the quarter, a time typically associated with more volatile price movements.

This environment could amplify the impact of large whale withdrawals, potentially leading to further price declines.

Further analysis suggests that Solana might find potential support at $130, aligning with the 0.236 Fibonacci retracement level.

This could be a critical point for price stabilization following recent declines.

Implications for Investors and the Solana Ecosystem

The unstaking and potential selling by whales could reduce the staking ratio, which is essential for the network’s security and transaction validation.

A lower staking ratio might discourage new investors who are concerned about the network’s long-term viability.

However, it’s important to note that Solana remains a significant player in the blockchain space, with ongoing innovations and project launches that could help stabilize its price in the future.

On the other hand, a recent analysis by CoinGape suggests that while the immediate impacts appear bearish, there might be potential for a longer-term recovery.

According to the analysis, the SOL price might target $150 as liquid staking listings increase.

At the time of writing, the SOL price is trading at $137.19, marking a 1.84% decline over the past 24 hours.