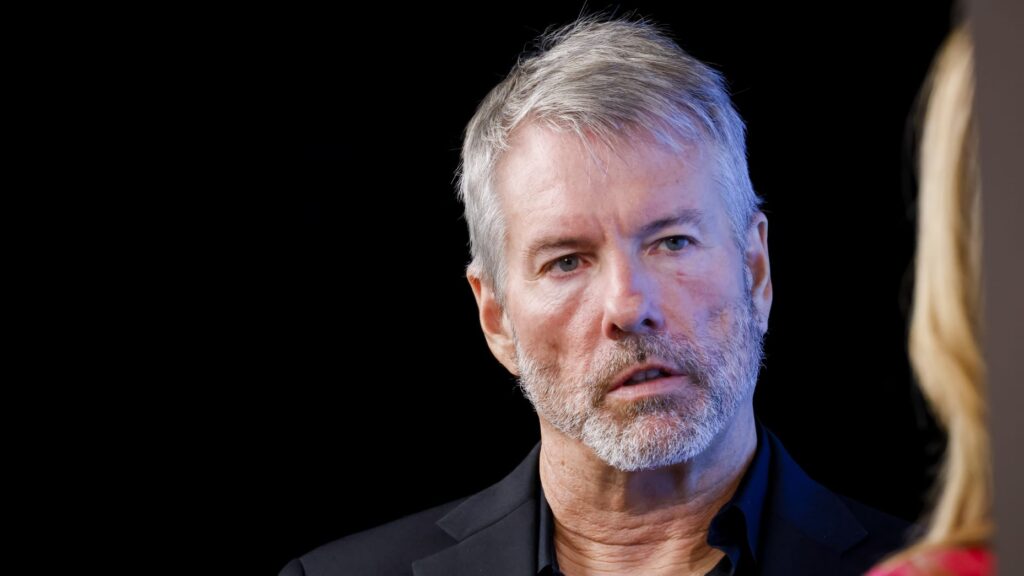

Michael Saylor celebrated MicroStrategy’s rise on X, noting its position above Amazon and Alphabet in daily trading volume, with over $5.8 billion on October 25.

For the first time, MicroStrategy, renowned for its Bitcoin (BTC) investment strategy, has ascended to the top echelon of the U.S. stock market, surpassing Amazon and Alphabet in daily trading volume.

The company appears to have solidified its position in mainstream finance by trading $5.5 billion on October 25, joining the “Magnificent 8,” as its executive chairman refers.

The Increasing Visibility of MicroStrategy

Saylor celebrated MicroStrategy’s new status on X, emphasizing Bitcoin’s increasing influence in disrupting conventional market hierarchies.

The self-described BTC maximalist shared graphics from FactSet in his post, indicating that the business intelligence platform had surpassed tech titans Amazon and Google’s parent company, Alphabet, regarding daily trading volume.

According to the data, MicroStrategy stock exchanged hands for over $5.8 billion on October 25. Amazon reported a slightly lower figure of $5.5 billion, while Alphabet’s figure was less than half that of MicroStrategy, at $2.43 billion.

The company’s financial growth has been significantly impacted by its Bitcoin holdings, valued at over $17 billion and amounted to 252,220 BTC as of October 28.

According to Yahoo Finance, the enterprise analytics platform’s stock has experienced a 444% increase in the past year, with a year-to-date increase of 244%.

Additionally, BlackRock, one of the world’s largest investment firms, which incidentally also supports Bitcoin through its exchange-traded fund (ETF) offering, increased its stake in MicroStrategy to 5.2%, solidifying institutional confidence in the company.

Saylor Recommends Bitcoin to Microsoft.

Saylor recently engaged in a playful conversation with Microsoft CEO Satya Nadella, urging him to consider Bitcoin as part of the company’s business strategy.

The proposal, which Saylor characterized as a “trillion-dollar opportunity,” was made in response to reports that the National Center for Public Policy Research plans to present a proposal at Microsoft’s forthcoming annual general meeting to invest in the leading cryptocurrency.

MicroStrategy’s stock had outperformed Microsoft’s by 313% in the past year, as the conservative think tank emphasized, bolstered by its BTC holdings. This was even though the former only conducted a small portion of the latter’s business.

However, the Microsoft board has opposed the proposal, calling it “unnecessary.” They said they had already “carefully” considered the matter and felt cryptocurrency volatility did not suit “corporate treasury applications.”